Note: This piece was originally published over the weekend in our Sunday newsletter. Want content like this delivered to your inbox before it hits our blog? Subscribe here.

The Big Story: Health insurers soak in pandemic-fueled Medicaid growth

As Americans lost jobs and suffered major financial hits last year, Medicaid rolls swelled. Insurance companies are reaping the benefits because they now manage roughly 70 percent of Medicaid enrollees.

Our Take

(2-minute read)

It’s a strange time. More than eight in 10 adults think healthcare is too expensive, but who to blame? Everyone’s trying to figure out where to point the finger, and everyone in our industry is jockeying to position themselves as THE patient advocate.

But what do patients think? You know, those people actually receiving the care being offered and funded by our $3 trillion industry.

We decided to ask them through a quick survey of 500 U.S. adults.

Easy stuff first: In a predictable landslide, 85 percent said that healthcare is too expensive.

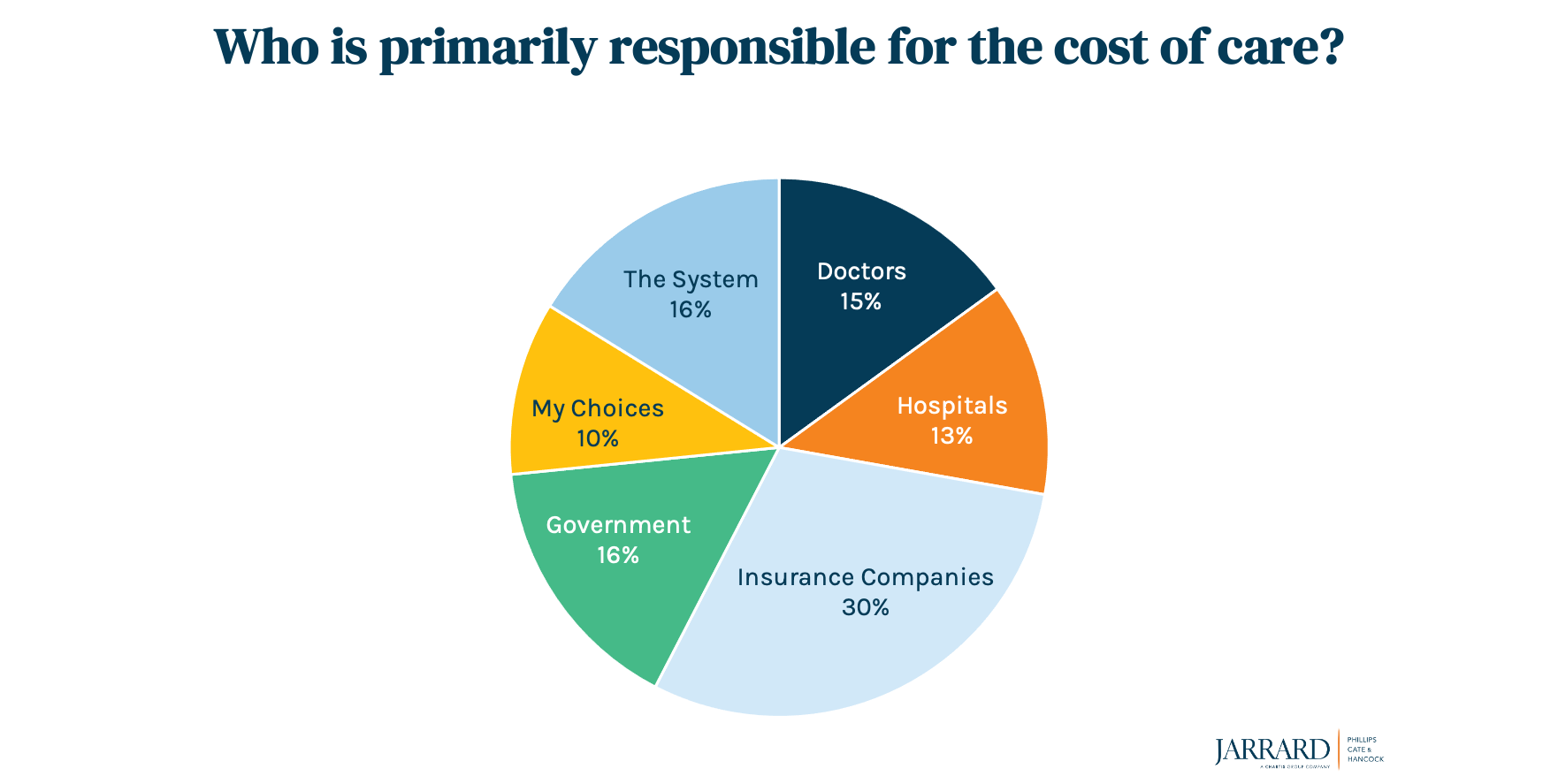

Next question: Who is primarily responsible for the high cost of care? Almost twice as many respondents (30 percent) blamed insurance companies vs. the next biggest culprit, “the system as a whole” (16 percent). About 13 percent cited hospitals. Women – the primary healthcare decision makers – were more likely to blame insurance companies than were men. On the other hand, men distributed their ire a bit more evenly among the various options, though insurance companies still edged out the dubious win.

It’s an intriguing wrinkle in a moment where we’re hearing of mixed results in payer-provider negotiations – some talks are collaborative; others are gloves-off, with payers squeezing hospitals for lower reimbursements. Meanwhile, insurance companies are enjoying the profits they accuse hospitals of pursuing and growing their revenue through increased management of and enrollees in ACA plans, as noted in The Big Story.

All of these pieces – and there seem to be a lot of them lately – add to the imbalance between insurance companies and those who are actually, well, providing healthcare. (Of course, even that distinction is blurring as insurance companies pursue vertical integration).

So, let’s look at a few facts to help balance the conversation:

- Rural hospitals across the country are at increasing risk for closure, potentially leaving wider and wider gaps in care.

- Safety net hospitals are barely hanging on.

- Payers managing the Medicaid population seem to be doing just fine.

- The five biggest health insurance companies control 44 percent of the market.

- Medicare Advantage and Managed Medicaid grew from 26.8 percent of payer revenues in 2007 to 51.6 percent 10 years later, per Axios. That means they’re making more money from managed care even as providers make less relative to private insurance due to lower reimbursement.

- Seventeen percent of in-network claims in ACA marketplace plans were denied in 2019, and only a fraction of a percent are ever appealed, according to a Kaiser Family Foundation study. That means insurance companies managing those marketplace plans are putting consumers on the hook for the cost of care.

- MACPAC reported that “There is no definitive conclusion as to whether managed care improves or worsens access to or quality of care for beneficiaries.” More on that story can be found in this article from NPR, also linked in the Axios piece above.

There’s a campaign taking shape against providers in the halls of Washington and the pages of the press.

In a sense, it’s an effort to change the survey results you see above. Will it take hold? Time will tell. For now, though, we see that people are more likely to point the finger at insurance than hospitals. Hospitals have a solid reserve of goodwill earned from their long history and pandemic heroism. That’s a reserve they must not squander.