We’ve had a few weeks to absorb the news of Amazon’s latest foray into the healthcare space. And we’ve mulled over the words of Neil Lindsay, Amazon’s health services chief, who told the Wall Street Journal on the day of the announcement:

“’We think healthcare is high on the list of experiences that need reinvention,’ said Neil Lindsay, senior vice president of Amazon Health Services. ‘We see lots of opportunity to both improve the quality of the experience and give people back valuable time in their days.’”

Reminds us of an anecdote shared by John Sculley, legendary former CEO of Apple and Pepsi. In a famous story, he recounted how he helped create the two-liter soda bottle, redefining beverage delivery. Seems people wanted more soda at home, but glass bottles were a pain to deal with – expensive, heavy, breakable and hard to deliver. So, Pepsi worked with DuPont to build a light, large plastic bottle. The rest is history.

Sculley drew parallels between his two-liter bottle and healthcare. The current model, he said, is complex, unwieldy, expensive and hard to deliver. It’s ready to be bottled in a different way. In a way that people want and need.

Primary care is ready for its own two-liter bottle. Apparently, Amazon thinks the same.

Now that the initial wow factor of that news has passed, the long-term outlook for the Amazon-One Medical deal and its impact on healthcare in general is hazy. But some hints of change are emerging, including what appears to be an 1849-style gold rush.

David Smith, founder and CEO of healthcare advisory firm Third Horizon Strategies noted that the intensity around this deal feels a bit different. For years, he said, there was “exuberance” that care delivery would be rethought and reworked through disruptive outsiders. And there was activity that created change at the margins. But, generally, no massive disruption. Referencing Haven, Amazon’s previous high-profile healthcare venture when it partnered with Berkshire Hathaway and JP Morgan Chase, Smith said that while it was a highly touted, “It was the first time I saw something of a collective yawn. There was an element of, ‘We’re not buying it, this time.’”

He maintains now that the pendulum has swung back with the One Medical news. Though unconvinced about how truly disruptive it will be in the end, the buzz he’s hearing is that it has “disruptive potential.”(For more on why Smith is a skeptic, see our Q&A with him here.)

Amazon wants to be a leader in “dramatically” improving the consumer experience when it comes to healthcare. For years, healthcare insiders have talked about an industry that’s facing disruptive forces and needs to improve. The catalyst? Consumer choice. While others are grappling with how to offer that, Amazon, Walgreens, Walmart and CVS have developed strategies that are deeply informed by their understanding of consumer behavior. Their challenge has been working through the care delivery part. So, this may be the moment when the stars align as a major force for change. One Medical is a consumer play and among the first of its kind from inside healthcare. Their new owners have essentially defined the modern consumer experience.

Smith said that Amazon has “an intriguing perspective to delivering care” as a tech business able to amass important information on its users and create a more frictionless, seamless and even integrated experience for patients. “If Amazon can bring that discipline to how a person thinks about their health and how they interact with the healthcare system, that’s something to be excited about,” he observed.

Primary care is valuable and essential. It’s an entry point to the rest of the system and critical for managing health. But primary care has low margins and needs scale to succeed on a business level. That’s hard to do, yet necessary for patients. And it’s attractive for investors who are ready to find that scale. Over the 15 years of its existence, One Medical has taken the time to build a model that appears to work, that people like and that has some traction. Amazon recognizes that steady growth.

Still, there’s a long way to go. “If Amazon/One Medical can activate the demand side and create a bolus in scale, that will make them a power center,” said Smith. “But the pathway will require far more scale than One Medical has today.” Critically, he said, it will also take a lot of trust for people to be comfortable shifting from buying their books and office supplies and baby formula to buying healthcare.

Depending on your perspective, Amazon and Optum have been either the bully or the hero in pushing transformation on the industry. So far, Amazon’s movement has been limited. It’s been sandboxing ideas, testing opportunities. As our colleagues at The Chartis Group put it,

“The company’s earlier investments and ventures (including PillPack, Halo, Amazon Care, and even Haven) seem to have provided learnings and building blocks.”

This is their biggest healthcare play yet. And it also feels different. It shows that, despite its failed Haven dance party with JP Morgan and Berkshire Hathaway, Amazon isn’t walking away. In one sense that’s a challenge to established players. But it can also give confidence to others, particularly in the health-services realm. It’s a signal that these types of plays are worth risking. We don’t know how this will shake out, but we know the healthcare sector is exposed both in the customer experience and the innovative process. Whatever happens with this marriage will affect both of those things and provide some validation for others.

As non-traditional players and health-services organizations redefine the consumer experience and build new models of care, there’s obvious pressure on hospitals and health systems. This points to hospitals slowly trending as places where really sick people will go.

Furthermore, it strengthens the emerging blend of virtual and in-person services that’s already re-written the rules for retail. Sri Mani, a director in The Chartis Group’s Private Equity Advisory and Strategy practice, said that this was one of his first thoughts when seeing news of the acquisition. “It begins to signal that a company that is built on virtual provision of services recognizes that not everything can be virtual,” he said. “Some things such as healthcare need a human touch.”

In this deal, he noted the hybrid of virtual and retail needed for primary care today. For traditional providers, it’s finding the appropriate blend by shifting from in-person to virtual, and for Amazon, it’s about shifting in the opposite direction. “They’re going to help us establish what the balance is,” he said.

This blended, hub-and-spoke model of care is becoming a reality. But the spokes aren’t necessarily owned by the hub. This doesn’t have to be unwelcome news. In fact, it might be liberating. Hospitals and health systems can use that to their advantage – taking bigger risks towards projects designed to improve the patient experience. Opening the door to new partnerships. Working with disruptors to create a referral pipeline so that each organization is providing the care it’s best suited to – and in the most efficient, convenient, cost-effective way. Eventually, that benefits everyone, even if the transition is painful. Amazon isn’t backing down, but it also has a long way to go. That leaves the door open to traditional providers and health services companies to do what they do so well while continuing to add a virtual component to care delivery.

And that’s not even mentioning Amazon’s own expansion in other areas, such as their August 5 acquisition of iRobot. (Might Amazon replace environmental services teams with Roombas at One Medical offices?)

When asked what lessons investors and other health services companies could take from this new partnership, Mani said, “It’s a signal to other companies out there. One Medical was the largest of them all – it was publicly traded, had the name recognition. And they sought out an acquirer right now. Should those other companies do the same?”

Mani noted that we’ve entered a market where volatility has made issuing equity challenging “If you’re any of these other parties who want to issue equity or borrow to fund new acquisitions, it’s tougher now,” he said. “You have to tell a growth story that’s really compelling because you have to juxtapose it against what happened at One Medical.”

So with Amazon’s strength in scale, capital, customer loyalty, data collection and analysis, supply chain and logistics and integrating digital with physical. What happens to the traditional provider? Mani is particularly focused on the local element, with a series of questions that no one has answers to, yet:

Let’s close with two reality checks:

Even with those caveats, Amazon splashing the cash is always important to watch. Not as a threat. But as a guide from which we can take ideas and use as a framework to consider how our organizations can pursue more efficient, cost-effective and consumer-friendly approaches to our work. It’s a chance to rethink our glass bottles and maybe come up with something just a little bit lighter.

"*" indicates required fields

David Smith is an expert in healthcare’s evolution, spending his professional time watching – and advising on – market trends, data and technology and how healthcare organizations can plan for the future. So, we checked in with Smith, who’s founder and CEO of healthcare advisory firm Third Horizon Strategies, for his takes on Amazon’s recent acquisition of primary care company One Medical. We also offer seven observations on what the deal means here.

Jarrard Inc.: What’s the feeling around the acquisition now that some time has passed?

David Smith: A few years ago, every time there was an event – or even whisper of an event – with Microsoft or Apple or Amazon, there would be an irrational exuberance. The feeling was, ‘These guys have figured out how to grow and scale and they understand consumers, so they’re going to figure out healthcare!’ And time after time, we haven’t seen a lot of disruption from these entities.

That led to something of a jaded reaction to these kinds of announcements around, say, 2017 or 2018. Haven is an example where there was a lot of press but also a bit of a collective yawn.

With One Medical, the pendulum has swung back a bit. A lot of smart industry people believe this has some disruptive potential. My sense is that the industry is cautiously excited about what this might portend for disrupting the traditional outpatient model.

JI: Does it matter what the healthcare industry thinks? Or is Amazon just going to do what Amazon is going to do and those of us in healthcare are getting hyped up?

DS: Where it should matter to Amazon or to anybody studying this is that industry professionals represent the collective wisdom and experience of decades of trying different reforms. Sometimes that can make their perspectives biased.

So, on the one hand, when it comes to disruption you don’t always want to take every word from those being disrupted. On the other hand, there is a lot of useful wisdom in that collective institutional experience. The fact that there’s some exuberance here suggests that there’s a sense Amazon is capable of doing something with the One Medical asset that other outpatient entities or institutional investors like Optum are less capable of doing.

JI: What else is driving the exuberance? Why now?

DS: Even though they do a lot of commercial business and B2B business, Amazon at its core is a tech-enabled consumer-oriented business. In that context, Amazon has successfully disrupted just about any other industry they’ve gone into. So, they have a track record. Still, the healthcare landscape in this country is littered with people with track records that tried healthcare and weren’t successful.

In my view there are two sources of exuberance:

The first is that, as a technology business which has created different pathways and nodes to amass important information on its users, Amazon’s potential ability to create a more frictionless, seamless, perhaps even integrated experience for patients is intriguing. Amazon has made it very easy to purchase things; they’ve made it very easy to access information. So, one area of enthusiasm is that if Amazon can bring that discipline to how a person thinks about their health and how they interact with the health system, that’s something to be excited about.

The second area is where the rubber meets the road. Amazon by itself is not going to be able to wield some kind of unique contracting power with health insurance companies. To be blunt, consumerism is really important, but we also need to acknowledge that, in this country, the healthcare dollar and how that dollar is allocated and organized is not a decision consumers make.

Amazon’s ability to be successful revolves around that first area. If they can activate the demand side and start to create a bolus in scale, moving them into a position where they can influence and shape how consumers are interacting with the system, that would make them a power center.

JI: Do you think they can do it? What are the caveats?

DS: Amazon has scale. They understand consumers. They understand technologies. That’s important but even so, there aren’t many examples of a heavily capitalized tech entity that has purchased a healthcare asset and been able to replicate the secret sauce that scaled their platform and extended it to healthcare. The economics in this industry are just so wildly different from any other.

If Amazon can activate significant demand, that kind of power center can wield the economics a lot differently. But the pathway to getting there would require far more scale than One Medical has today. It would also require the ability to gain the trust of a consumer who today is buying books or baby formula or office supplies. That consumer now has to look to Amazon and say, ‘I trust you to be my healthcare guide,’ and creating that trust is a monumental task.

JI: Pulling all of this together, what’s the opportunity for One Medical?

DS: Driving change and shifting the market are things that health systems, outpatient groups, health insurers and even governments are not great at. Employers have the potential to do it, but that requires employers coming together to think about how to wield their collective purchasing power. The challenge is that anybody who’s tried to harness and redirect the collective purchasing power of consumers in this country has typically done it for a narrow niche of the industry rather than comprehensively.

We’ll also need to watch the hundreds of thousands of permutations of healthcare finance. It changes by community, by payer, by rules, what’s written in, what’s carved out, how much is paid for any given service. And so not only do you have to aggregate different consumers and different communities with different levels of access, you have to do that in the context of highly unique healthcare ecosystems.

So that’s the biggest opportunity and challenge. If One Medical’s ambition is to do this at scale nationwide, they’ll start to look at these things more regionally and start to create patterns whereby they can aggregate and focus demand. That has the potential to begin shifting the economics.

"*" indicates required fields

Want to be notified as soon as we publish new content like this report and the Quick Think? Subscribe here.

Says Moody’s Analytics chief economist: “The economy is close to stall speed, moving forward, but barely.”

Aggressive inflation and the bitter medicine of rising interest rates are the latest gut-punch for providers serving in an endless pandemic, holding together an exhausted workforce, assuring anxious patients and striving to stay relevant and in business.

You’ve seen the plot points for a while. Wage wars. Rising medical debt. Tense payer negotiations. Hesitant, cash-strapped customers. The lack of supply and the cost of, well, everything, from gloves to scrubs to the burgers served in your food court.

But taken as a whole, where does this story take us? Paul Keckley wrote this week that he sees the impact in at least three broad categories.

But how does this big picture affect our agenda for this week’s leadership team meetings? As leaders and communicators, what do we do now?

Good question. To help, we tapped into our Jarrard Inc. brain trust and asked colleagues who work alongside providers big and small this question: “What does ongoing inflation and uncertainty mean operationally, and how should communicators address it?”

Here are their takeaways.

By Abby McNeil, vice president, National & Academic Health Systems Practice

Bad debt will rise. That holds true for institutions and patients. Focusing on patients, systems may consider offering greater flexibility on payment terms to help manage the burden and minimize people delaying care due to cost concerns.

Communications Imperatives:

By James Cervantes, vice president, National & Academic Health Systems Practice

Competition and expectations will increase. Though they earn more than the average American, like the average American, their home pay is not keeping up with inflation. After record rises in 2021, inflation is set to again outpace expected physician salary growth of two to four percent in 2022. So those three percent increases provider organizations consider doling out to docs don’t go so far in showing the love.

Add to that increasing physician burnout, shifting Medicare fee schedule rates and growing reluctance to pay out shared savings – due to uncertainty and lower hospital margins – and you’re likely to have more unhappy docs coming through hospital doors. It’s a great opportunity for private equity firms, who are investing in physician practices with renewed vigor. For them, the promise of streamlining operations, reducing management responsibilities and increasing compensation makes for an attractive package.

Communications Imperatives:

By Isaac Squyres, partner, Regional Practice; Teresa Hicks, associate vice president, National & Academic Health Systems Practice

Unions will be pushing. Persistent inflation in an already highly competitive job market could easily lead to continued pressure on labor costs for providers. This time around, it won’t be driven by the cost of travel labor as much as current employees looking for higher-than-customary cost of living and/or merit increases. Don’t be surprised to see unions using inflation during upcoming negotiations as leverage to push for wage increases.

Communications Imperatives:

By Isaac Squyres and Abby McNeil

More hospitals will be for sale, fewer buyers will be available. The eye-watering inflation figures keep triggering rate hikes, with another 75-point rise this week. That will continue to increase the cost of capital for systems evaluating potential deals from the buy-side and lead to pressure for those on the sell-side. With financing set to get harder and more expensive to access, highly leveraged organizations will feel the stress on their balance sheets. Large banks may already be pulling back credit availability to their big customers, potentially leaving organizations to go through other lenders or private funds to get through new projects or even to cover current needs.

Communications Imperatives:

By Teresa Hicks

Everyone will look to cover shrinking margins. The jump in consumer prices is cranking up the heat in the pressure cooker that is payer/provider relations. Each side is bringing that extra stress to the negotiating table.

Communications Imperative:

By Sheila Biggs, associate vice president, Health Services Practice

Pressure to execute will increase. After a hot run of investment in 2021, economic uncertainty is starting to cool healthcare PE in 2022. That trend may continue as inflation points to a decent chance of recession. Valuations are now stabilizing after reaching significant heights over the past 12 to 18 months. The result? A greater focus on dialing in the operations and path to steady growth for existing portfolio companies. Resources and expertise will be deployed towards optimizing what’s already there, ensuring a pristine product-market fit and an emphasis on providing a great experience for patients and employees. In the end, that benefits everyone.

Communications Imperatives:

By Erika Matallana, associate vice president, Regional Practice

A perpetual problem will reach more people. Interest is growing in food-as-medicine. But with prices rising, the ability to use non-medical interventions to heal or prevent disease has become more difficult. Documented in countless reports over the years, many vulnerable populations have never had the option of food-as-medicine. Whether urban communities of color or the rural poor, purchasing healthy food has long been a financial stretch – if fresh vegetables are even available. What’s new now with inflation: The threshold for who can approach food-as-medicine has been raised, and even unhealthy food is becoming more expensive.

Communications Imperatives:

By James Cervantes, vice president, National & Academic Health Systems Practice

Competition and expectations will increase. Though they earn more than the average American, like the average American, their home pay is not keeping up with inflation. After record rises in 2021, inflation is set to again outpace expected physician salary growth of two to four percent in 2022. So those three percent increases provider organizations consider doling out to docs don’t go so far in showing the love.

Add to that increasing physician burnout, shifting Medicare fee schedule rates and growing reluctance to pay out shared savings – due to uncertainty and lower hospital margins – and you’re likely to have more unhappy docs coming through hospital doors. It’s a great opportunity for private equity firms, who are investing in physician practices with renewed vigor. For them, the promise of streamlining operations, reducing management responsibilities and increasing compensation makes for an attractive package.

Communications Imperatives:

By Isaac Squyres, partner, Regional Practice; Teresa Hicks, associate vice president, National & Academic Health Systems Practice

Unions will be pushing. Persistent inflation in an already highly competitive job market could easily lead to continued pressure on labor costs for providers. This time around, it won’t be driven by the cost of travel labor as much as current employees looking for higher-than-customary cost of living and/or merit increases. Don’t be surprised to see unions using inflation during upcoming negotiations as leverage to push for wage increases.

Communications Imperatives:

This piece was originally published over the weekend in our Sunday Quick Think newsletter. Fill out the form to get that in your inbox every week.

"*" indicates required fields

Healthcare and society are now two years into a period of renewed focus on improving diversity, equity and inclusion for both those employed within healthcare and those served by it. The hope, after devastating inequity and bias were brought to light through the pandemic and George Floyd’s murder, is that this “period” will in fact be permanent. It’s well past time to finally solve the lack of diversity within the upper echelons of healthcare and the gaping chasms in access and health equity between white and Black (as well as brown) populations.

So, then, what progress been made in the past two years? Is momentum being maintained towards bringing more Black voices and experience into healthcare, not just in word but also in deed through investment of FTEs and financial resources?

With the second federally-recognized Juneteenth holiday just passed on Sunday, the Jarrard Inc. DEI team, which operates under the Kaleidoscope name, wanted to get a sense of what’s happening across healthcare.

To do that, we sent questions out to some of our expert friends from across the industry whose work centers on DEI in healthcare – and beyond.

Every contributor reminded us that representation matters – it’s table stakes. And several pointed out the importance of organizations and leaders meeting people where they are by developing initiatives that fit with how those affected already live. That, rather than trying to pull people in and putting the burden on them.

Here are six themes from our conversations. Full quotes from the interviewees can be found below.

"*" indicates required fields

Healthcare mergers and acquisitions are having an interesting moment and were quite the topic of interest at April’s American Health Law Association’s Health Care Transactions Conference. As has been reported numerous times over the past year or two, the number of deals has dropped but the average size has gone up. Questions about how the current administration and FTC would approach consolidation have been a talking point across industries since now-President Biden won the presidency. Some massive deals go through, others get scuppered. And in the middle of these moves by traditional providers, private equity continues to evolve its role in healthcare delivery, bringing organizations together and backing them with capital and operational guidance.

With that backdrop, we circled back with a few of our AHLA friends to get their impressions of the current healthcare M&A environment. Specifically, we asked them:

Here are the topline takeaways. Quotes from the experts follow.

Uncertainty and concern around regulatory scrutiny of deals remains. And it’s not just from the FTC, but from states, as well.

The cost and shortage of labor, particularly travel nursing, is having downstream effects on the cost of doing business and patient outcomes.

In the PE world, valuations are rising but not always for reasons one might expect. In many cases, multiples are pushing valuations as much as margins are.

It’s not just small, independent organizations that are being buffeted by a tough financial outlook. It’s a rocky landscape even for large systems, and that will likely be seen soon in M&A volume.

Across the board, seasoned industry veterans are expressing a notable level of concern thanks the rising cost of doing business and the added scrutiny on transactions.

Running a clean, organized transaction process is more important than ever.

Get counsel involved early to stay ahead of regulatory roadblocks.

Make the case for a deal – clearly and early.

Health systems we talked with have been upended by the trend of traveling employees, especially nurses. In many cases, the cost structure of the organization has risen by 20 percent. The impact can not only be felt in the financial statements, but also in quality and safety measures. Temporary staff are often working in unfamiliar departments, with new equipment, and without the muscle memory on a team. The New York Times covered this well a few ago:‘Nurses Have Finally Learned What They’re Worth’

Health systems we talked with have been upended by the trend of traveling employees, especially nurses. In many cases, the cost structure of the organization has risen by 20 percent. The impact can not only be felt in the financial statements, but also in quality and safety measures. Temporary staff are often working in unfamiliar departments, with new equipment, and without the muscle memory on a team. The New York Times covered this well a few ago: ‘Nurses Have Finally Learned What They’re Worth’

The degree to which historically high-performing systems have been shaken in 2022 was a surprise. While we don’t yet see the impact on M&A volume statistics, I think we will in the coming quarters.

Transparency is key. Designing and implementing a competitive process to provide fiduciary decision-makers with a basis of comparison has always been central to demonstrating to regulators (e.g., state attorneys general) that the terms and conditions achieved in a particular transaction are “fair.” Where a lot of systems go wrong is not using the LOI stage to proactively communicate the rigor of the market clearance, the rationale behind the combination and merits of the partnership to AGs.

My biggest takeaways were related to the conference’s antitrust track. Essentially, between the FTC’s new “holistic approach” to merger review and the increased scrutiny on affiliations, we can expect more vigorous reviews on the federal level. When you layer that with new state laws requiring pre-transaction notifications, the shifts could have material impacts on the approach and timing of some transactions.

Given the pace of PE transactions in 2021, I was surprised to learn that unspent capital is still near record highs.

Prepare and prepare some more! Provider organizations considering a transaction would be well served to understand their organization’s operations, the market conditions, and the basics of the regulatory landscape. Deals are still moving very quickly whenever possible, and being well organized with good professional support can make a big difference.

Whether it is on the equity and funding side, or on the compliance side, healthcare transactions are under a tremendous spotlight from every level. Couple this scrutiny with a greater demand by sellers for creative upside capture (e.g., earnouts, aggressive liability limitations, representation and warranty insurance growth, etc.), and there is significant pressure on what the market will support in transactions.

Healthcare transactions are always under scrutiny, so many practitioners see it as simply part of the practice. But hearing so many seasoned practitioners raise the flag on the new long-look landscape was eye-opening.

Transaction fundamentals matter more than ever. That means good governance behind an organized, clean transaction process being run by reputable counsel. Add in the antitrust scrutiny and greater examination of transitions, and I think we will see an uptick in deals that stall, fail or unwind – and that’s when the quality of the transaction will be examined in the public and courtroom.

The keynote speaker discussed the returns on investment for private equity investments in healthcare. One of the statistics mentioned was that almost half of the returns enjoyed by PE investors in healthcare in the last decade have come from the increased multiples. Meaning, the improvement in multiples provided as much of the return on investment as revenue increases and margin improvement combined. Can we expect multiples to continue to increase over time from current levels?

I heard an overall uncertainty, and some anxiety, regarding the level of anti-trust enforcement going forward. The administration has definitely communicated an increased focus on healthcare transactions, but the level of enforcement beyond acute care seems to be uncertain.

Also, an interesting fact conveyed by the keynote speaker is that valuation creation in private equity-backed entities, historically, has been through revenue and multiple expansion, not margin expansion. That leads to the question if such growth is sustainable.

The biggest surprise to me is the prior noted comment regarding the lack of margin expansion in private equity-backed deals. This runs counter to the MSO model of creating efficiencies through scale to generate incremental value.

I think the tried and true approach of involving competent healthcare legal counsel early in the process to navigate regulatory and transactional landmines remains key, along with involving healthcare-specific financial and compliance advisors. Several stories were shared at the conference of bad outcomes when this isn’t followed.

"*" indicates required fields

Welcome to DigitaLee, the podcast for healthcare marketers, where we look at the digital news, tools, tips and tricks for effective healthcare communications. This week, David Shifrin and Lee Aase are both confused by CVS moving into selling virtual healthcare goods. Once they get past that, they look at provider organizations planting the flag in the metaverse, and then it’s the second of our two-part digital ROI miniseries, this one on how healthcare marketers can position digital programming to justify the ROI.

Listen and subscribe to the podcast, or read the transcript below.

David Shifrin: I’ll be honest. I’m confused by this story today. It’s from Healthcare Finance News and it’s, you know, I’m confused, but got to talk about it. I want to talk about it. “CVS Files Patent to Sell Goods and Healthcare Services in the Metaverse.” And when you read through the article, it’s not exactly clear exactly what CVS is going to be selling, because if I fall and slice my hand open, I don’t need a metaverse stitching and bandage, I need an actual emergency room. But this is continuing with this rapid rise in stories that we’re seeing about what the metaverse is doing and can do. And of course, Facebook has rebranded to become Meta and virtual reality is here and expanding.

So yeah, what is your take on digital goods and services?

Lee Aase: Yeah, I thought I was confused by it as well, because it says, you know, “CVS Health wants to trademark its logo, establish an online store, create downloadable virtual goods ranging from prescription drugs to beauty and personal care products.” I’m thinking, are we going to have a virtual opioid crisis?

Or what’s the deal? Just like, how does virtual work in that? So I’m not really sure. I think there’s, I mean when it really gets down to it, I think some of the telepresence stuff that was talked about in the other article that we’ll be talking about, and I apologize for jumping ahead with it, but it seems like the, it seems like the immersive experiences for really making that virtual connection be much more like face-to-face.

And perhaps even in some ways because you can have some digital measurement sensors attached with them, I think there are some opportunities to really enhance that experience. I think the main thing, the main thing out of this story is something that does relate to what I’ve advocated for a long time, is that when a platform comes out that it’s really important for big brands to be staking their claim, you know, that they don’t want somebody else to be squatting on their name.

We had an experience when I was at Mayo Clinic that we had, there was a British rock band that set up a page on MySpace called Mayo Clinic and the band’s name was Mayo Clinic from County Mayo in Ireland. And they thought that was cute, I guess, but so that gave us some impetus for being able to say hey, we should set up… This was back when Facebook pages were the new thing. We said let’s set up a page on Facebook to make sure that nobody else claims that. So I think this is just sort of taking that next step on the legal front, that where CVS is saying, okay, metaverse is going to be a thing, so let’s at least stake our claim here, and set out the stakes that we are CVS in the metaverse and nobody else can use that.

David Shifrin: So it’s protective as much as it is proactive.

Lee Aase: I kind of think…so, I mean, that’s what it looks like to me because I have a hard time wrapping my head around how virtual goods can be. I can see virtual services totally. But virtual goods seem a little bit disconnected.

David Shifrin: Yeah. Well, and the article also mentioned that they’re talking about potentially selling NFTs, non-fungible tokens, which is a whole other Pandora’s box that we’re not going to get into right now, but that’s the other big thing. And again, personally I don’t see the value in buying any, I don’t know what kind of NFT CVS is going to offer me that’s going to make me want to spend the money, Bored Ape Yacht Club isn’t even enough to get me interested. So I don’t know what CVS is, but…

Lee Aase: Yeah, I think there’s, you know, NFT and then there’s another acronym that uses both T and F as well, but maybe kinda…

David Shifrin: I think we found the title for this episode.

All right. Before this goes off the rails Lee, let’s move into the second section which, as you telegraphed, is more on the metaverse, again not really a platform specifically, but a digital place. This is from a Forbes contributor named Bernard Marr who writes on enterprise tech. The title is “Amazing Possibilities of Healthcare in the Metaverse” which got us thinking again, the metaphor as a place, as a platform of sorts. There’s sort of three areas that Marr references: telepresence, which you’ve mentioned, digital twins, which is really interesting, and then blockchain technology, which we hinted at there with talking about NFTs, but you know, some of this stuff is pretty immediate—I think like the telepresence of being able to offer telehealth visits in the metaverse or simply just by good old fashioned Zoom call. And then some of it like the digital twins is incredibly fascinating and I think promising, but a much longer play. This is mapping people’s genetics, so they can, we can experiment virtually and to see how we’re going to respond to treatment. So what are you looking at as the metaverse continues to get more, more traction?

Lee Aase: Yeah. I mean, I definitely think the telepresence part has a lot of application right away. And I think that’s where organizations could, especially in things like counseling and therapy sort of approaches, be able to have that much more immersive experience; to have it be much more like being there would be I think that’s a no brainer. And then, and finding…so I’d suggest that for organizations, finding someone, finding an advocate within the organization, within the clinical areas, who’s really interested in applying this, coming around them and helping them to prove the concept and show the value I think is really a good opportunity.

The digital twinning does sound fascinating. I just think it’s hard to…I think it’s problematic in just even as you note, as you map the whole genome, how do you know exactly whether you’re taking into account the right factors as you’re fast forwarding through 10 years, about what happens with, you know, the whole idea of like, you take a twin and you say, okay, maybe you could run a thousand simulations and be able to then come up with a… Actually as I think it through, I think that might be it, the Monte Carlo simulation with digital.

So it’s not just digital twins, it’s digital…you’re creating a population out of the twins. So just as with Moore’s law and the power of computing increasing exponentially, probably eventually at some point you’d be able to run those sorts of simulations that might give you a better sense of what the range of possibilities would be, given a different intervention.

David Shifrin: Okay. In the meantime of that while the scientists and the data folks are trying to figure out how to do all of that – and we just talked about kind of staking a claim in wherever you are as an organization – the metaverse becoming a more powerful place for brands to engage.

And so any other prep work that folks should be thinking about? Whether that’s with HIPAA compliance, training clinicians to be thinking about one day possibly entering virtual reality to deliver telehealth, anything along those lines?

Lee Aase: As I alluded to a little earlier, I think the key is to find the champions, to find the early adopters who are willing to experiment and learn. Willing to help sort out what the issues are going to be, so that then the organization can apply it on a broader scale.

So it’s part, and this kind of relates, probably segues into our ROI discussion for this time, that, as I mentioned before in my thesis, that as the I approaches zero ROI approaches infinity. One of the big ways that you keep the I low is by getting people to volunteer—by getting people who are already on staff to say wow, this is really cool and I want to focus my energy on this. I’m willing to dive in and put in my own effort on it.

And so that’s that kind of makes the organization more like a startup, you know, even an established organization where you’ve got a lot of people that are psychically betting on exercising options, so to speak. I mean, they’re trying to, they’re creating some psychic ownership in a new trend and because of the personal satisfaction that they get out of leadership in an area like that. So I think finding, identifying and recruiting people from within the organization that you already have to say would you like to play? would you like to be involved in this? is a way to be able to demonstrate that the potential to demonstrate the return without a major outlay of additional resources so that you can prove the concept and then hopefully make the case for a broader adoption.

David Shifrin: Okay, in our next conversation, we may, maybe we’ll talk about kind of setting up how you set up a sandbox with enough guardrails to be careful but also giving people the freedom to test that out.

In the meantime: digital ROI part two and talking about how healthcare marketers position digital programming to justify that ROI.

And you’ve talked about it last time, and then just before this is the last thing you said there was hopefully take the results on to the rest of the organization and leadership and show the value. What does that look like? How should digital marketers think about helping to get their leadership teams bought into these programs that they’re testing out?

Lee Aase: I think the first thing is they have to be solving a real problem that the organization is either spending money on now or creating new opportunities for generating income. So it’s either, how can you concretely save money through some of these digital innovations?

So for instance, if it’s telepresence, okay, you’re saving time on travel in between meetings and you’re enabling people to be able to be more…have less overhead in terms of those face-to-face relationships and interactions. So figuring out ways that you can measure and make the case for that, for the savings that are coming there. But then also beyond that in testing and learning and seeing where the additional revenue opportunities are, and by trying this out are we able to make additional connections that will lead to patient volume, will lead to memberships or whatever the model is of acquisition?

David Shifrin: Alright, Lee, well, thanks!

"*" indicates required fields

A. People have the attention span of a goldfish.

B. Local news is dead.

C. People aren’t willing to consider opposing viewpoints.

D. People trust family and friends.

E. People don’t trust institutions.

F. People watch, not read.

G. All of the above.

You went for G, right? Because when it comes to communications today, each of those axioms pops up with regularity. It’s impossible to catch – and hold – your audience’s attention. There’s little room for discourse. And we won’t even start on the impact of short, flashy and content-lite videos published to TikTok, Snap or YouTube.

How’s anyone supposed to cut through the noise when there’s a serious point to make and the world is distracted scrolling through memes?

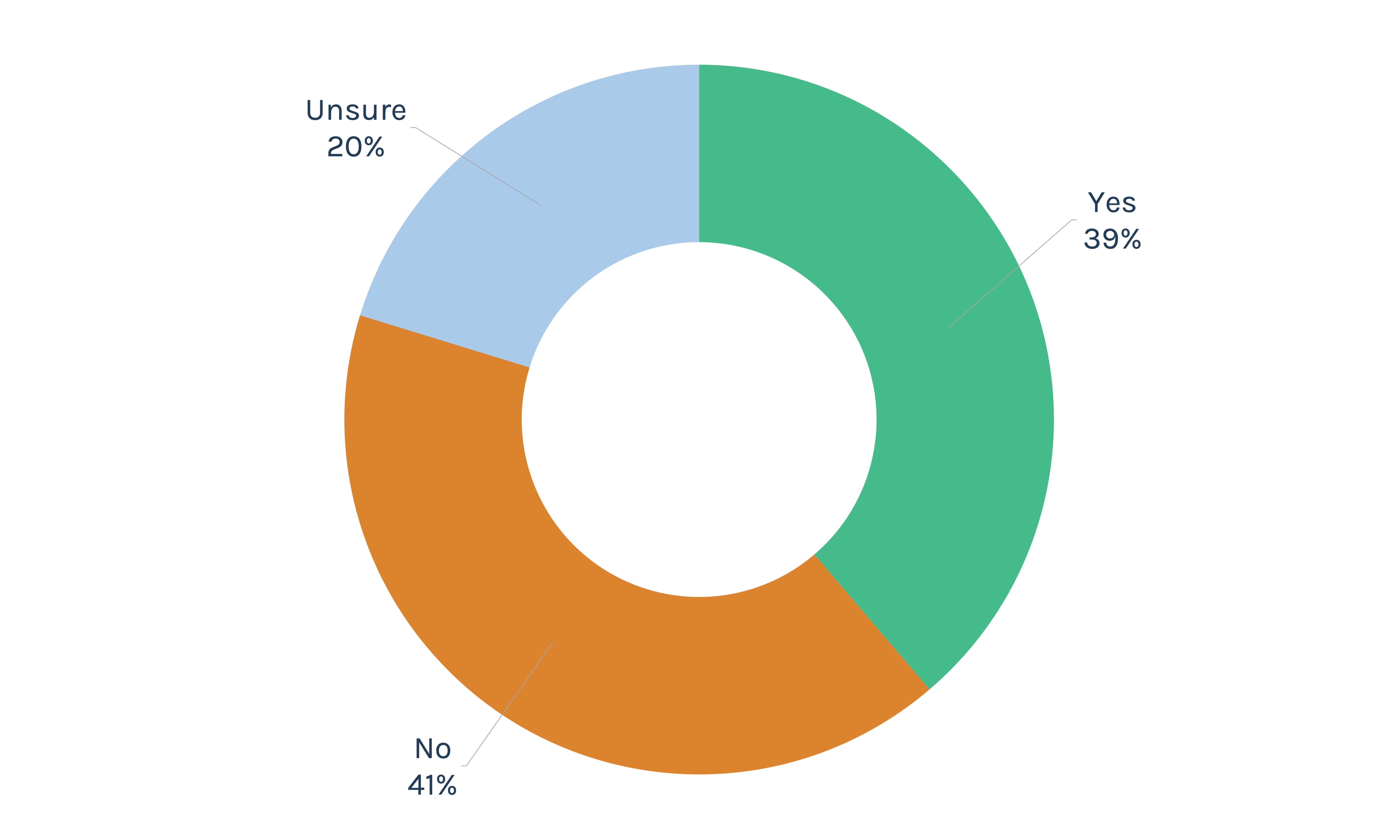

We know. But first, let’s see if your choice was correct. Our proof points come from a survey Jarrard Inc. conducted in early April. Responses that follow come from 800 US adults who answered questions about how they prefer to receive information, how often and whom they trust to provide it.

Here’s what we found:

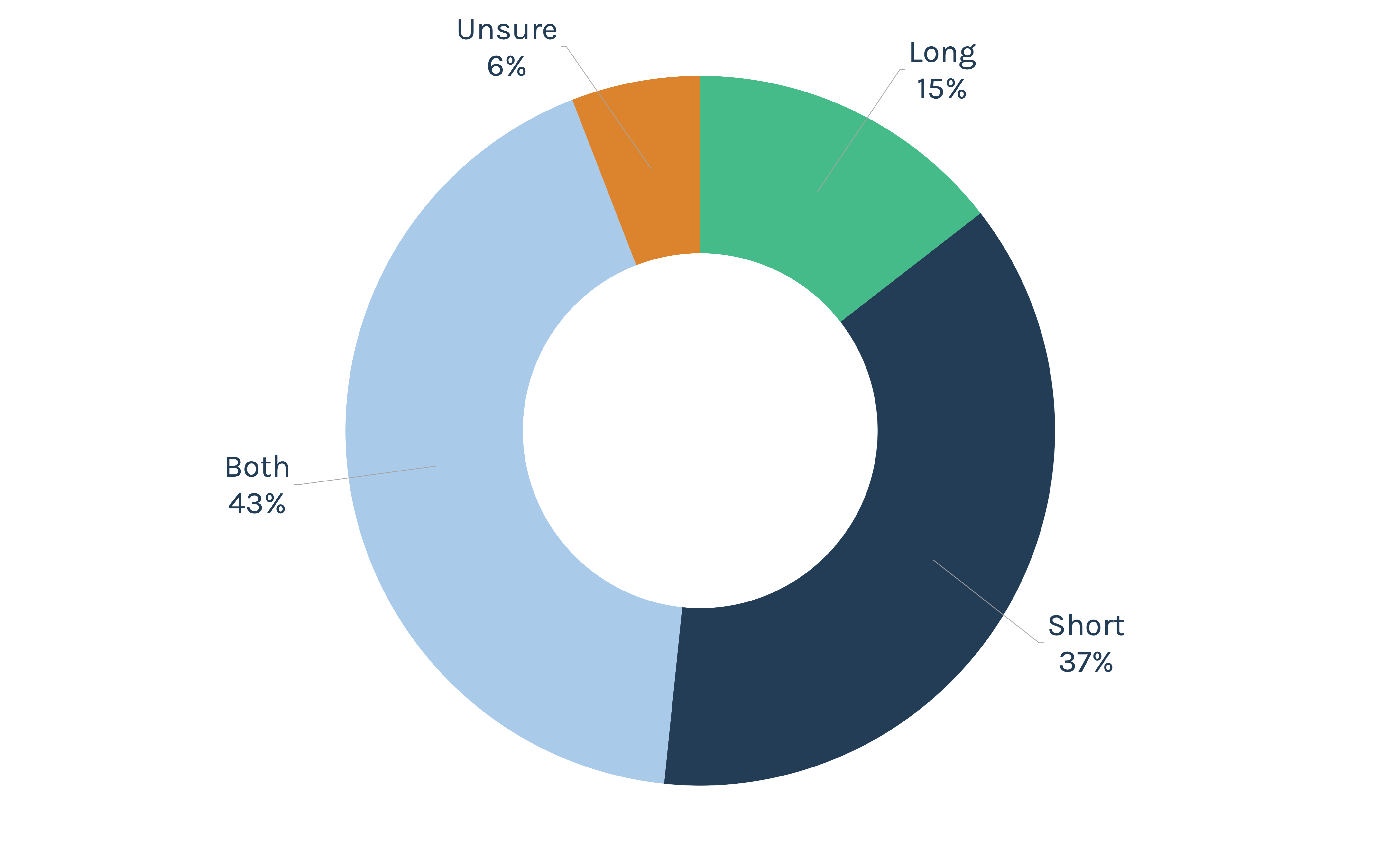

Not exactly. People do prefer shorter content. But they will take the time to go deeper. More than a third of respondents said they’re more likely to read short-form content on any given day, versus just 15 percent who said long-form. But a plurality – more than four in 10 – said the average day was likely to include both. In addition, 58 percent said they read long content a few times a week or daily – the same total as short content.

Wrong. It’s not. Well over half of survey respondents selected local TV as a source of news, and more than a quarter picked it as their top choice.

Though perhaps surprising, these findings are consistent with other studies over the past few years. A rapid decline in local TV viewership was arrested and somewhat reversed during the stay-at-home days of the pandemic.

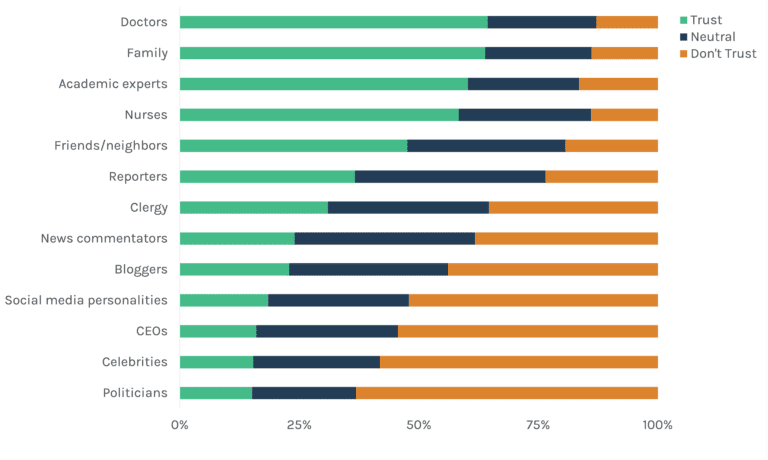

This checks out. Especially the family part. Throughout human history, people have made their way into tribes and are skeptical of outsiders. It’s evolutionary hardwiring in place to boost safety and overall success. Ergo, it makes sense that when asked about who they trust, family tops the list in a statistical dead heat with doctors. An important note here about that trust in doctors: If you’ve been following our surveys for a while, you know that we consistently highlight physicians and nurses as trusted voices on healthcare issues. This survey – related to but distinct from that series – asked a more general question about whether people trust information in general from different sources, not just healthcare information. That doctors remain at the top of the list shows the depth of that inherent trust, even beyond their professional expertise.

The slightly wider circle of friends and neighbors is far less trusted, yet still sits at almost 50 percent. People want social proof and trust loved ones – even above information they find when looking for insight on a topic.

Importantly, though, expertise is still highly valued, with academic experts and nurses rounding out the list of most-trusted individuals. Family matters, but so does deep professional training. CEOs, brace yourselves. You barely avoid the bottom spot, perennially occupied by politicians.

This checks out. Especially the family part. Throughout human history, people have made their way into tribes and are skeptical of outsiders. It’s evolutionary hardwiring in place to boost safety and overall success. Ergo, it makes sense that when asked about who they trust, family tops the list in a statistical dead heat with doctors. An important note here about that trust in doctors: If you’ve been following our surveys for a while, you know that we consistently highlight physicians and nurses as trusted voices on healthcare issues. This survey – related to but distinct from that series – asked a more general question about whether people trust information in general from different sources, not just healthcare information. That doctors remain at the top of the list shows the depth of that inherent trust, even beyond their professional expertise.

The slightly wider circle of friends and neighbors is far less trusted, yet still sits at almost 50 percent. People want social proof and trust loved ones – even above information they find when looking for insight on a topic.

Importantly, though, expertise is still highly valued, with academic experts and nurses rounding out the list of most-trusted individuals. Family matters, but so does deep professional training. CEOs, brace yourselves. You barely avoid the bottom spot, perennially occupied by politicians.

(Scale of 1-5: 1 = Do not trust, 3 = Neutral, 4-5 = Do trust)

(Scale of 1-10: 1-3 = Very little, 4-5 = A little, 6-7 = Somewhat, 8-10 = A great deal)

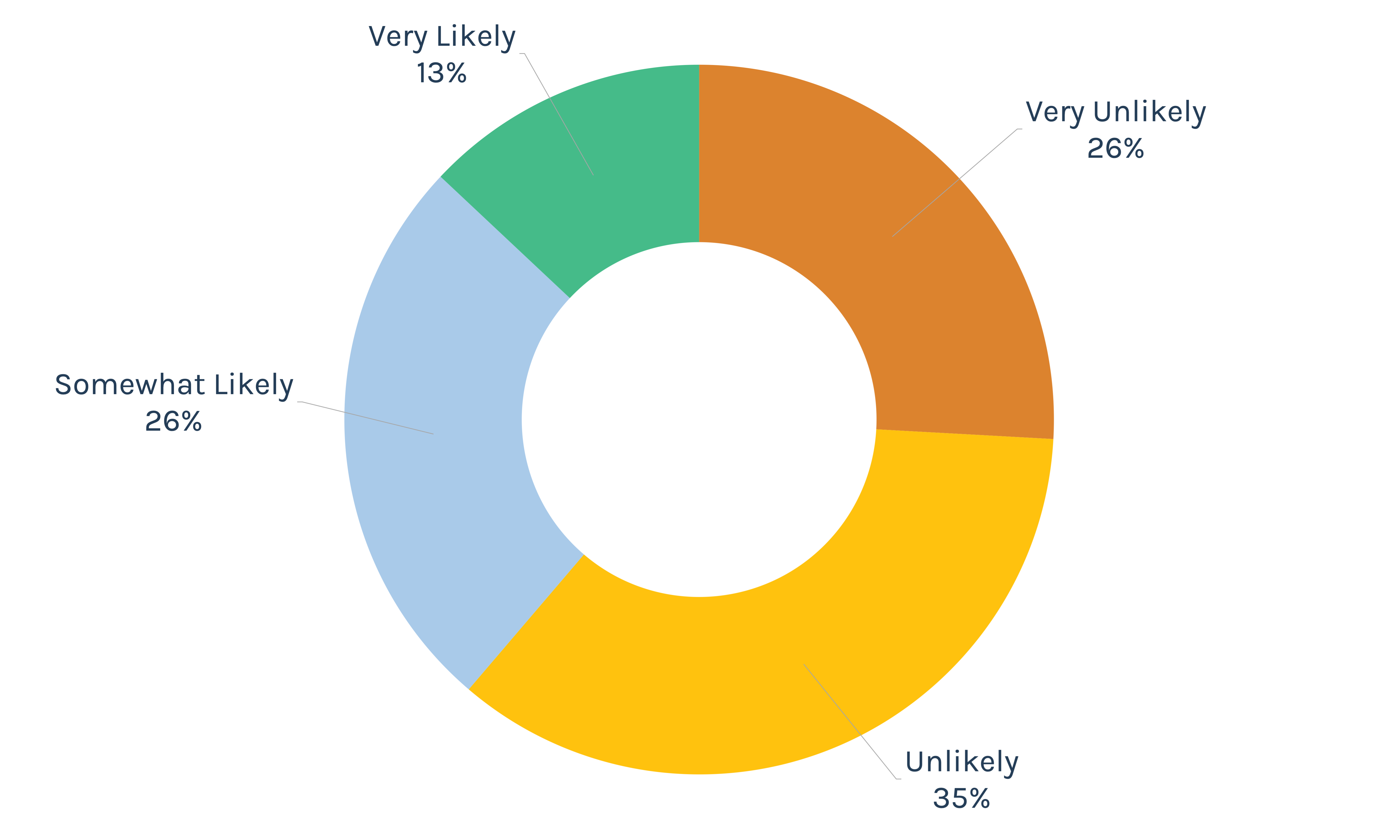

This was quite the surprise. In this time of bumper stickers, polarization and tribalism, it seems counter to the conventional wisdom that people might be willing to consider ideas they don’t already agree with. Yet, almost four in 10 respondents say they had in the past year changed their opinion based on ideas from someone with an opposing viewpoint. And another 40 percent says they just might.

Of course, this is all self-reported and might reflect the respondents’ desire to be perceived as open-minded than actual open-mindedness in practice. Even so, this is cause for optimism. Because, at minimum, there’s a segment of the population that wants to be thought of as open-minded.

True. If family and doctors are highly trusted, CEOs are, well, not. Though not asked in the survey, it’s not a big leap to see how the idea of a “CEO” here could be interpreted as either the individual – the head of a corporation – or as a proxy for the corporation itself. The dark suit, if you will. This is a warning for any institution and leader. People are relational, looking for information and reassurance from other individuals while holding a notable skepticism of organizations.

Video is king. If you’re in marketing and communications, you’re keenly aware that short, visually engaging content is the way to consumers’ hearts. Our survey reinforced this position. Almost half of people expressed a preference for video – 18 points above written text and 3.5-times more than audio. This doesn’t mean that other media are dead. Just that visual content must be a core component of any communications strategy.

Those are the findings. Now, what does it all mean for healthcare communications?

From our survey, one core message supersedes all others:

There’s a tendency to measure success by activity, not influence. Yet the real movement may be hidden.

It’s away from measurable campaigns like social media and billboards. And it’s found in the conversations between doctors and patients, family and friends. The ROI of relationships and interpersonal trust is unquantifiable but invaluable.

For marketing and communications advisors, this is straight talk that bears repeating: Our activity is not “it.” The hard work is in earning the conversations that take place around the dinner table.

There’s hardcore – though perhaps not entirely quantifiable – benefit to “Dinner Table ROI.” The local and personal nature of communications, trust and healthcare – along with the high trust doctors and nurses continue to enjoy – means that healthcare brands may very well be sturdier than the hot-take Twitterati say they are. The experience a strong brand provides is far more enduring than a Twitter storm. If you’ve built a strong reputation, then when the hot takes come in, those dinner conversations will include a heavy dose of people telling their loved ones, “That wasn’t my experience,” or, “I’d still go see Dr. Smith.”

We’ve written before that providers should not passively rely on an historic positive reputation. Or on the personal trust between doctor and patient. Foundational as those things may be, they’re not inviolable. Patients can choose to follow a physician rather than a hospital. And the low trust in institutions means that no corporate reputation is safe, especially in a time when hospitals are under significant fire. We stand by that advice and suggest that the strength healthcare organizations maintain is a starting point to build from, not a resting place.

How to build? Forget the Three Rs. Your answer lies in Six Ts.

The first step to moving someone to action isn’t giving them new information. It’s overcoming resistance to receiving new information. “It’s a long journey to persuade people even to receive the information, much less change their mind based on it,” said Teresa Hicks, associate vice president in Jarrard Inc.’s National and Academic Health Systems Practice.

So focus internally first to make the most of that time, says Abby McNeil, vice president in the National and Academic Health Systems Practice. While there’s a lot of value to be had in media relationships (see sidebar) healthcare communications leaders need to focus initially on physicians, employees, partners, and other internal stakeholders. “Because we trust people we know most, their experience, along with the patient/consumer experience, is what moves the needle fastest with brands either in a positive or negative way.”

There’s good and bad in the trust numbers from our survey. On one hand, it’s easier to receive information from a cherished sister or brother instead of reading a stack of articles for yourself. “There’s an element of comfort that comes from that relationship,” Hicks noted. Yet depending on the information shared between sisters, that could be a good thing – “Go get your COVID-19 vaccine!” – or a bad thing – “the COVID-19 vaccine contains tracking devices!”

Kim Fox, partner and Regional Practice lead at Jarrard Inc., added, “The dinner table is a safe place. You can explore your perspective and feelings there. You can openly be your true self, whereas you often can’t in other settings.”

For healthcare organizations, the charge then is:

And what of spokespeople? Well, your physicians, nurses and academic experts remain high on the trust list. CEOs? Not so much. We think that in many cases, the word “CEO” could easily be viewed by many as a proxy for “corporation.” When faced with a critical message – or even just day-to-day communications – provider organizations must be careful to use the person who is best suited to deliver it, even if that person may not be the most prominent. We typically see this in advertising: It’s white coats in hospital TV ads, not suits.

Of course, there’s also a big difference between “CEOs” in general and Jane Doe, CEO of Anytown Medical Center. So, there’s certainly an opportunity for any leader to be a trusted voice. That trust must be cultivated, which McNeil references in media training sessions. “I tell leaders they have to make deposits in the community trust bank daily, because at some point there will be an issue or a crisis, and they’ll have to make a withdrawal,” she said. “Those deposits happen at every single touchpoint with the brand.”

Last note here: Fox pointed out another subtle but important distinction in the trust numbers. “People don’t trust celebrities. Providers should be careful about if and when they use celebrities as spokespeople.” she said. “They’re known, but not trusted.”

We noted above that doctors aren’t just trusted on health information, they’re trusted even when the question is about information writ large. Why? Fox had an idea. Perhaps it’s because of their unique position as recipients of our secrets. “We may trust doctors because they hear things that we won’t say even to our families,” Fox suggested. While the dinner table is, in Fox’s terminology, a safe space, the doctors’ office is reserved for discussing a subset of deeply personal concerns. Arguably, clergy have historically held this position, yet they fell in the middle of the trust list in our survey (fallout from the decline of organized religion, perhaps). Could it be that the knowledge that our medical caregivers know things about us no one else does lead to trust, or even force it? Or is the trust necessary up front for us to feel comfortable being open with our physician? It’s an intriguing chicken and egg question we don’t have an answer to but will be pondering.

Almost everything we know has been interpreted for us by someone who understands it better than we do.

Sounds scary, but is it? Not really. We need experts to discover and then translate since no one knows everything. Society needs specialists to develop ideas and make discoveries, but then it also needs a series of people to translate that information into something we all can use. And at the end of that chain must be a trusted, one-on-one interaction.

That’s why hearing from a family member is far more palatable than digging through mountains of primary literature.

So too with health information. Healthcare providers need to remember that the process of translation is good and necessary. Done correctly, the process makes the complex and unintelligible something that can be processed by, well, anyone who isn’t the expert. This means investing in people and processes that can review critical messages and adapt them as needed. It’s taking an active approach – not just asking a charismatic physician to go out and extoll the virtues of vaccines or colonoscopies. It’s building a pipeline to finesse information into a format and level that is exactly what the audience needs. Playing a huge role in this is your marketing and communications team who should both identify the core message, shape and review it for accessibility and then develop final products that engage the end user.

Smart healthcare providers invest in training trusted voices to communicate effectively.

“We can work to make the people who can translate trusted,” said Hicks. “But… that’s a lot harder than finding someone who’s already trusted and giving them the skills they need to translate.” That doesn’t mean sending community leaders to a crash course in immunology and vaccine development, but it does mean sitting down with them and the specialists – those in the first and second layers of translation, if you will – to walk through the information, its impact and how people should respond.

You’re familiar with examples of health systems working with clergy to promote the COVID-19 vaccine. Another example could be a local facility engaging with EMS directors across a community to explain how and why consolidation of emergency services will work – and why it makes sense for the community.

“Whatever the topic is, finding the people who already have earned the trust of their community and investing in convincing those people to share the information is the way to go,” Hicks said. “Because this survey shows that people trust relationships more than they trust data.”

Whatever the message and whomever the messenger is, how should it be delivered? Here’s where that preference for short form and video comes in to play. The data is clear and is largely consistent with marketing and communications best practices, so we won’t dwell on this tactic for long.

Still, it’s worth noting that the results reinforce the value of brief videos, delivered on a regular basis. People are looking at short-form news a few times a week. They strongly prefer video over audio and text. Therefore, they’re primed for that style of communication when it comes time to look at health information.

But remember that, despite the preference for short-form content, there’s a place for long-form. Those quick hit pieces can be backed up by deeper materials for those who want more. Fox noted that there is always a need for multiple channels. The survey, she said, reminds us that “People will still read a good story. Not everything has to be three paragraphs long. There’s a market there for deep content, as long as it’s well-written, well-researched and thoughtful.”

By that, we mean experience. Consider the “body language” of an organization and the experience it offers. “Perception comes down to experience,” McNeil said.

The right words at the right time are important but not remotely sufficient. More significant is creating a good experience at every stage of the patient and employee journey through the organization. She referred to the survey data as “a callback to how we show up with patients and consumers, with employees and physicians, every single time.”

Remember that a sizeable portion of the population either is open-minded or wants to be perceived as open-minded. Remember, almost 40 percent of survey respondents said they had changed their opinion in the past year based on an opposing viewpoint. Both demonstrate sensitivity to social norms.

Therefore, those leading communications for provider organizations should be encouraged to keep up with efforts to persuade – whether the issue is public health measures or service line changes.

The key is to build those messages into bite-sized, emotionally compelling nuggets that can be easily delivered through personal relationships far away from the PSAs and media campaigns. Then, as the door is cracked wider, have ready more in-depth information that will build momentum towards the end goal rather than put people into vapor lock through confusion, defensiveness and decision paralysis.

Remember: Every opportunity to back the story up by a personal, positive and comfortable experience serves as a deposit in the bank.

“No presentation with vast amounts of data will be palatable enough to make someone change their mind,” said Hicks. “It has to be the relationship that does that.”

A key finding of our survey was that local news is not dead. What should healthcare providers do with that? Our Jarrard Inc. team has some thoughts on the state of the media:

Want more specifics on how reporters want to be pitched? Here are a few very tactical stats from the Muck Rack State of Journalism report:

"*" indicates required fields

This week we were honored to help produce a full panel discussion with four top healthcare marketing and communications leaders discussing team dynamics and navigating the C-suite. It’s a conversation around how marketing leaders and their teams can use their seat at the table to not just be scribes for their hospital or health system but to serve as strategic leaders and advisors.

This conversation is a prelude to a panel discussion the group will be having on Tuesday, May 17th at the Health Care Marketing and Physician Strategy Summit (HMPS) in Salt Lake City. For more on the event, check out healthcarestrategy.com.

Be sure to listen and subscribe to the High Stakes Podcast.

Note: This piece was originally published over the weekend in our Sunday newsletter. Want content like this delivered to your inbox before it hits our blog? Subscribe here.

“A jury sided with Sutter Health on Friday in the long-running federal lawsuit accusing the health system of anticompetitive business practices that drove up healthcare costs by more than $400 million.”

(3-minute read)

The short version of what the Sutter result means: One specific health system won one specific legal battle.

That’s it.

Time for more? Read on.

The California health system’s case is making waves in the healthcare trades and among industry insiders. Understandably so. A large system received a favorable jury verdict regarding alleged anticompetitive practices in an environment where that outcome was far from a foregone conclusion.

But while Sutter can take a breath, the provider side of the industry can’t. Or at least shouldn’t. Because this legal result does nothing to change the big-picture issues that are facing hospitals and health systems. Remember that this case began a decade ago and has focused on insurer contracts and antitrust issues, which have direct implications for the cost of care and patient access. Those topics are as hot today as they were 10 years ago.

A few key points stand out when looking at the decision. Note: We’re not making any statements about the legal issues. For that, we’ll recommend this concise piece from our friends at Bass Berry & Sims.

So, yes, the case may have an effect on contracts in California going forward. But this verdict is a sidenote when it comes to the overall trends in healthcare and public perception thereof. The critics are simply reloading.

So how should providers react?

This piece was originally published over the weekend in our Sunday Quick Think newsletter. Fill out the form to get that in your inbox every week.

Subscribe to Our Thinking, valuable insights for healthcare execs, communicators and marketers.