Welcome to DigitaLee, the podcast for healthcare marketers, where we look at the digital news, tools, tips and tricks for effective healthcare communications. This week, David Shifrin and Lee Aase talk about the news that Netflix is cracking on their long-standing policy of going ad free. Then Lee gives an update on the rent versus own debate – and that’s with regards to blogs and social media, not the housing market, although that might be an interesting discussion too. Finally, they close by talking about Lee’s latest venture the HELPCare Clinic as an example of how digital tools can help personalize health care.

Listen and subscribe to the podcast, or read the transcript below.

Read the Transcript

David Shifrin: Well, hey Lee, going to kick off this week with the story about Netflix and streaming platforms. I almost bypassed this story because when I was looking around for digital healthcare marketing and saw this story about Netflix, I thought it was going to be just riding the coattails of all the discussion around Netflix.

And then I realized that it was from MM&M – Medical Marketing and…now I’ve forgotten what it is. What?

Lee Aase: Medical Marketing and Media.

David Shifrin: Medical Marketing and Media, they also rebranded not that long ago, I like their new logo. Anyway, despite the fact that I can’t remember what the 3 Ms stood for, it’s a solid site. They do some really good work. And so I thought it’d be worth clicking into it. The upshot of the article is that with Netflix now considering advertising, that could potentially change the game for companies looking about, looking at advertising in particular. I thought the really interesting point was that with economically thinking about this potential recession that we may be looking at, that is going to change sort of the ad spend and may open up some opportunities for smaller and mid-sized businesses to get in the game.

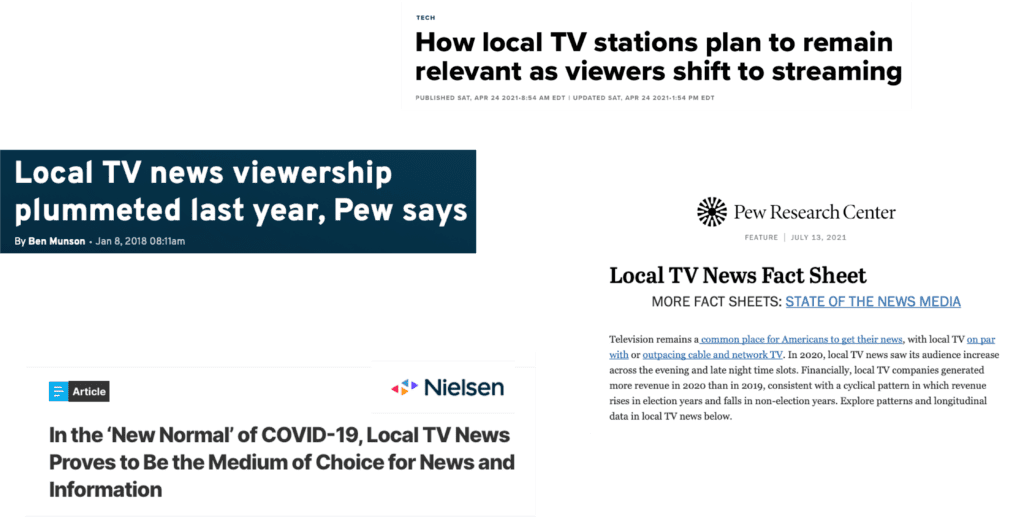

Lee Aase: Yeah. I just think it’s an amplification or it’s a multiplication of the number of places where advertisers can be, you know, and that as the continual fragmenting of the audiences, I mean, previously the Netflix audience has been inaccessible. Once somebody’s locked into Netflix, once they’re watching it, they’re uninterruptible and that’s actually been part of, a big part of the appeal as well is that people are able to watch things without being interrupted.

So, figuring out how that works within the Netflix platform will be interesting. But so many of these streaming services that are…Netflix had its 200,000 subscriber loss, and I think some of the others, being so many of these services that’ll supply demand. And especially if there’s an economic contraction that may open up space for smaller players to be able to get access to get their content into some of these niches that might fit really well with what their strategic goals are.

So I think it’s, yeah, the technology that the evolution of these platforms and their being ready to explore the ad supported, or at least partial ad supported, element is going to create some opportunities.

David Shifrin: How much do you think healthcare organizations should pursue this? And I don’t have numbers on this, but just thinking about my own viewing habits, which are primarily streaming, but I do watch regular or cable TV, I see…I can’t think of really any healthcare. I see some, I do see some pharma ads on streaming.

But you know, if I see an ad for Vanderbilt, my local hospital, it’s going to be on a local channel or on cable. It’s not coming through on an ad on Peacock, for example. So you know, how much value is there, and you’re talking about the audience fragmentation, is it worth a local hospital trying to get hyper-local targeting?

Lee Aase: I think that just depends on it might relate to what the initiative is. And is there a particular type of program that aligns really well with, we talked in the previous episode about some of them, diversity inclusion topics and initiatives.

There may be some places where if you’re able to get hyper-local targeting within these platforms, in addition to then content targeting, that you could find… I’d say there’s some opportunity. I’m not saying stop everything else you’re doing and pursue this, but it’s definitely something worth watching.

And I think the folks that have the most money to spend on it—the pharma folks—they’ll be the pioneers in that, I think. And as we in the provider space, in the hospital space, see what’s what they’re doing, I think that’ll spur some thoughts and some innovation among some of the marketing leaders to say, Hey, yeah, we could, this might fit for this particular initiative.

So it’s worth keeping an eye on.

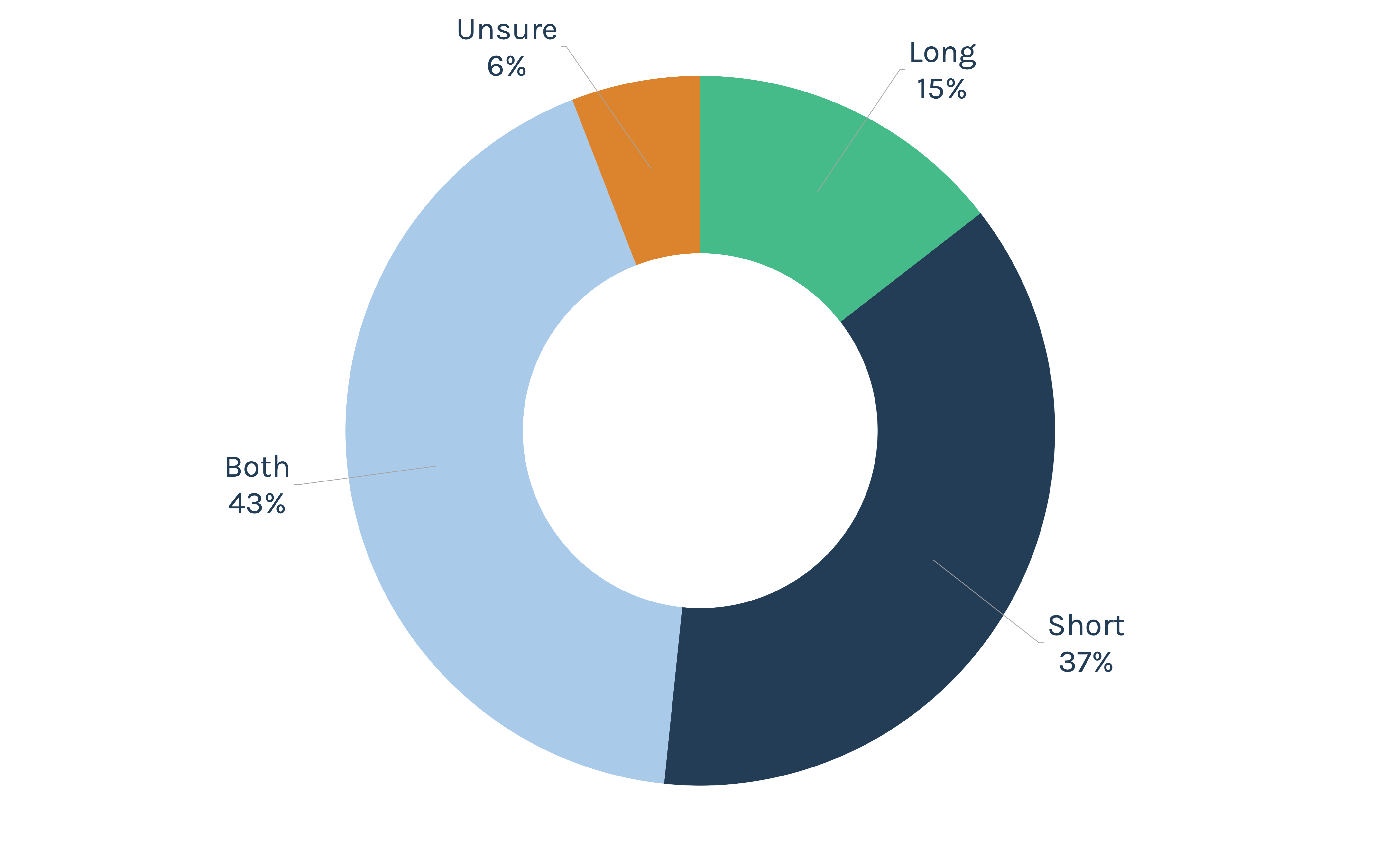

David Shifrin: For the trend, I wanted to ask you about the current state of play on renting versus owning. And as I produce the content for Jarrard, we have a blog, we have a LinkedIn presence, and thinking about how we balance all these different platforms and where to focus.

So I think conventional wisdom for a lot of years is that organizations that are producing thought leadership and content want to own the platform. So that algorithm changes, any other kind of rule changes, aren’t affecting your ability to get that information out there, which is something we see with social media sites all the time, right?

Facebook changes their algorithm about every 10 minutes and it constantly changes the ability to be visible. But at the same time, there’s a lot of people on LinkedIn. There’s a lot of people Tik Tok. So how are you thinking about reach versus SEO, renting versus owning, website blog versus social media, et cetera.

Lee Aase: Yeah. I actually think of it as renting and owning. I think it’s like, you need to have the home and then you need to have the apartment in the, in the downtown or whatever, you know, it’s like, you need to be in both places and that’s actually a really helpful thing to be thinking about.

Because my bias has been toward having the control, that you need to have a home base. It’s important to have that, but I also recognize that the—like LinkedIn, for instance—with the thought leadership when you’re posting long form or longer form content, instead of just a link to your blog post you get readership there with people who don’t want to leave the app, and so you’re getting some impact from that. So I think being able to have maybe different versions of things that are in LinkedIn versus on the home base, maybe it’s an extended excerpt that you’re doing on LinkedIn or some content that is bespoke, as they say, for LinkedIn…I wanted to use that word, cause I’d never gotten it before and it’s…

David Shifrin: It is. It’s a very, it’s like a, it’s a sort of a…

Lee Aase: A super fancy word.

Yeah, exactly, yeah.

David Shifrin: You’ve got turnkey and you’ve got bespoke.

Lee Aase: Yeah. Very good.

David Shifrin: Yeah. And something that we’ve been looking at recently on LinkedIn is their newsletter feature, which is not new, but it’s been slowly rolling out, and so we recently on our Jarrard account got access to it. And so I’ve been cross posting a lot of our content there, and it is effectively a secondary blog that people can subscribe to. It does seem to hit some folks who aren’t necessarily always seeing our content otherwise.

So I think it’s a good thing.

Lee Aase: Right. Yeah and you want to go where the people are. And if to the extent that you’re putting content in a place where it can be liked and commented and shared…in addition, just the convenience of reading it on platform versus having to click off to your website.

We have goals that we want to get people to our website; that is part of our core ideas. That’s how people sign up and like, they join with us and having a blend I think makes a lot of sense.

David Shifrin: Then finally for this week’s philosophical tip or philosophical discussion—philosophical might be little bit too lofty of a term but whatever—

Lee Aase: Yeah.

David Shifrin: I’ve been thinking about navigating the intersection of digital tools and channels with the really personal, intimate nature of healthcare. You know, there was something in the article that we just talked about, the MM&M article, about how advertising isn’t really meant to be hyper-customized because you’ve got to reach a broad audience, it’s got to be general. But healthcare is ultimately the most personal thing that you can have. It’s literally somebody touching you to help you through difficult times. And so I was thinking about this and then thought this is perfect because you’ve opened a clinic. You are doing this, you have an extensive career in the digital space and are now in a very personalized clinic. So how are you thinking about that balance of personal with something that’s a little bit more hands-off through a screen?

Lee Aase: Yeah, a big focus is that we want to make it so that technology is the facilitator for the personal, the technology isn’t a barrier technology, isn’t something that just enables us to scale. It does enable us to reach more people, does enable us to target to a community.

But also, we don’t want the technology to be something that gets in the way of those human interactions. We want it to be the enabler and facilitator of those reactions. And a lot of that is if it’s convenient for the patient to use video conferencing, if it’s a way that we can see them more easily, like they’re feeling sick and they don’t want to come in, that’s telemedicine: in the post-pandemic era, isn’t a like, ooh, that’s a whole new thing, but is an application of digital technology in a way that is more human because it is more individualized. It’s about that intimate relationship. So I’ve been blessed, pleased at how the technology, used in the right way, can be really that facilitator to make some of the things that would have been more difficult to do previously, much easier.

And so it’s been an exciting time to be starting something new because of the way that…well we talked earlier in, maybe it was in the previous episode? about some of the transcription tools and things like that that are able to be harnessed and used within a practice to just take it to that… take away some of the grunt work, where technology can take some of that effort out of the way that would enable then the human, the more direct human interaction at a higher level.

David Shifrin: Yeah, just the grunt work. That’s literally what you just said.

Lee Aase: Well, yeah, let me just, just let me just throw in another thing. So one way that we’ve used this is…so I mentioned previously Dr. Dave Strobel is our our medical director, our founder of the clinic, and one of the things he does is go into depth, great depth in describing conditions.

He’s an educator, he’s a teacher at heart, he loves to help patients understand what’s going on in their body and why and how all of this stuff works. And that’s part of the reason we have a one-hour appointment as our basic unit of seeing patients. There’s a lot of stuff that he says a lot of times, and so if we can use the vide to capture some of that stuff (and that’s part of what we’re doing), our production is like, this is the thing that you’ve said dozens of times, hundreds of times to people as you’re describing metabolic syndrome or the various other conditions. He’s got a video that we did on baby table manners, things like that in terms of how to get your kids eating solid food and kind of the right order to introduce foods.

You know, he could go through that every time. And he has done that for 30 years with patients, but if we can capture that and then say, okay, these are online video modules that are of specific, can be a specific interest to different elements of the practice, members of the clinic, then when they come in, they can have watched the video and they can go deeper and they can probe on the questions and we can say, what didn’t you understand? Or what could I explain better? And that helps us make the next, maybe add another module. If we find out that another video to the series, if we’re finding out that it isn’t communicated as clearly as it could be.

So I think that’s one way that if you can take the broader topics where there is some, it’s still pretty specific, it’s still pretty focused and in-depth, but then enabling to go even deeper within the individual patient visit.

David Shifrin: That’s where you go from a turnkey video series to a bespoke one hour appointment.

Lee Aase: Exactly, there we go!

David Shifrin: How do like that?

Lee Aase: Great stuff. Oh, how about that? You are a trained communicator and a PhD to boot.

David Shifrin: I’m just writing my notes here, getting my points in. All right. Thanks, Lee. It’s fun as always.

Lee Aase: All right. Appreciate it. Talk later.

Episode Links

Subscribe to Jarrard Insights & News

"*" indicates required fields