Ten years ago, Gary Keller and Jay Papasan wrote The ONE Thing: The Surprisingly Simple Truth About Extraordinary Results. It quickly became a bestseller in the productivity and self-improvement genres, giving readers ways to become more productive and successful by “focusing their energy on one thing at a time.”

The book includes what the authors call “the Focusing Question,” which reads, “What’s the one thing I can do such that by doing it everything else will be easier or unnecessary?”

In the complex, endlessly noisy work you will begin (again) as another year fast approaches, what is your “one thing?”

Every December, we gather a group of healthcare insiders to talk about what they observed in the year just gone and what they expect in the months ahead. This time, our panel consisted of Jarrard Inc’s own five practice leads, each focused on a different type of healthcare provider organization.

No surprise, there were some common themes that emerged. Those are below, and most deal with an element of healthcare itself, like nurse and physician engagement, or scrutiny of hospitals.

But throughout these conversations it was striking to hear several answer the question with a question of their own. We asked “If you’re in a room with a client or executive team, what’s the question you ask to help them get unstuck?”

Their common question? “What’s the One Thing we need our people to know, to say or to do?”

As Emily Shirden, Jarrard VP and National Practice lead put it, “If we can take whatever issue it is and boil it down to a sentence or two, that helps focus on what’s most important and then figure out next steps,”

And so, with the swirl of work to be done to advance each healthcare organization in the new year, highlight The One Thing made sense as the, well one thing to highlight. Whatever else comes, pause, boil it down, and focus that moment’s energy on the single next step.

Other angles to that that question our team suggested healthcare leaders ask:

There are, no doubt, many questions to ponder as you prepare for 2024. The challenges are great, the answers are hard, and the issues many and relentless. Review themes that our team is watching, and read excerpts from conversations with each practice leader below.

Then, take a breath, if you can, and reflect on the single focusing question that helps draw the many matters before you into contrasting relief. Take the iconic advice cowboy Curly gave to a greenhorn in “City Slickers” and figure out your one thing for the new year.

How does a given organization best serve its patient population through partnerships, technology and care models? Once that question is answered, when change is coming, it’s vital to think through and talk about the implications. It’s not simply telling people what you want them to hear. It’s being a good community partner – and employer – by giving stakeholders all the information so they can make their own decisions and then listening to their thoughts through surveys, listening sessions and one-on-one conversations.

Additionally, there’s an opportunity to grow through an emphasis on aligning the external brand with the internal culture. This helps create a unified, trusted experience that patients feel comfortable interacting with.

Stronger relationships are being forged between systems, hospitals and community health providers, underpinned by a shared, community-centric mission. Tim Stewart, Partner and Academic System lead, noted the importance of using partnerships to “find the best path forward that utilizes academic innovation and everything associated with ‘the ivory tower’ in a way that genuinely improves community health.”

SVP and Public & Community lead Letitia Fecher noted that public and community hospital boards are taking a close look at whether and how to partner up with other community hospitals or by joining a larger system.

In other cases, as highlighted by James Cervantes, SVP and Regional Practice lead, systems are creating internal structures such as joint ventures and subsidiaries that allow for innovation and flexibility in how they collaborate.

“Employees are any organization’s biggest ambassadors, and they’re seeing more and more how providers are making cultural investments,” said Partner and Health Services lead Hollie Adams.

Providers are redoubling an already concerted effort to prioritize their people. We’re seeing progress towards more diverse and inclusive environments. There’s greater creativity in how to develop and retain talent. Giving physicians and employees a say in designing solutions to an organization’s unique challenges is one way to both increase innovation and engage the workforce.

All of this bodes well for navigating the ongoing shortage, especially now that we’re seeing what appears to be a new baseline for the role of organized labor in healthcare.

Across the board, our practices are seeing the need to continue addressing the anti-hospital rhetoric and antitrust activity that has taken hold among corners of the media, politics, regulators and healthcare industry itself. In this environment, providers need to be quick to answer the question, “What’s our value proposition?” Cervantes asked, in the voice of an executive leader, “How are we different from the competitor down the road, even if we’re a regional system and they’re an academic center?” Healthcare marketing and communications teams must be involved in developing and then proactively presenting the answers to those questions.

There’s a governance element to this, as well. Provider organizations looking to make patient-focused changes must ensure they have a genuine financial and political commitment to amplify changes and advance things like price transparency. The board and executive team should be aligned on this work.

Regardless of their environment, people still crave interaction. Healthcare leaders and marcomm teams need to use all the tools and technology available to communicate clearly and rapidly, ensuring people know what’s going on – even when what’s going on might be uncomfortable. “We’re in the people business,” said Fecher. “We should be moving faster and communicating that we’re evolving faster.”

Multiple practices saw an uptick in cybersecurity incidences, and it has been a particular focus for our Health Services team. Careful preparation for a potential incident is vital, noted Adams. While a cybersecurity situation is never a good thing, one win our team observed in 2023 was better preparation for and response to incidents. Our team expects the need for this work to continue – the bad actors aren’t going anywhere. Organizations can get through, though, it with close alignment of communications, legal, operations, IT and others.

Our Health Services Practice serves the unique needs of innovative companies, including those backed by PE, focused on advancing healthcare outside the acute-care setting.

Growth strategy. This year we saw significant changes in transaction activity. It’s been much lighter than in years past, which has pivoted growth strategy to be focused more on same store growth than with acquisitive growth. As a result, firms have been encouraging internal engagement and ensuring that their current assets are growing – for example with a focus on patient acquisition – to strengthen existing investments.

That also includes bringing awareness to their brand both externally and internally, and ensuring that how they project themselves externally is reflected in who they are internally. Part of this is connecting with employees through engagement and culture work. Employees are the biggest ambassadors that any organization has and they understand what’s going on.

We saw a significant uptick in cybersecurity incident events, across all of our clients in 2023. The continued push towards greater digital assets and greater digital integration continues to set organizations up for those risks and vulnerabilities and being able to manage effectively through crisis. But, we’ve seen positive results with clients who have gone through data incidents with no scars. This will continue to be a vulnerability in the new year.

Going back to growth and acquisition, in the absence of high deal volume each transaction is even more important. So, we’re seeing attention on recruitment, internal positioning, value protection and in some cases holding on to investments a little longer than a PE firm had planned.

In 2024 we’ll see a heightened focus on value-based care. From a communications perspective, it’ll be important to advance the understanding of value-based care, as well as the financial and reimbursement pressures facing value-based care. Over the past few years, we’ve worked with several value-based care clients on helping them position themselves and articulating their value proposition, who they are and what exactly they do.

It will be interesting in an election year with the heightened scrutiny on providers. The antitrust lens is strong, and there’s a close eye on PE. Health services companies will need to be prepared for that. Each provider should go into 2023 ready to answer the question, “why are we essential to the ecosystem, what data do we have to back it up and what story do we have to explain it.” There can be no gap between how team members and patients/the public perceive these organizations.

Knowing that there are so many challenges, we tend to want to boil the ocean instead of prioritizing issues and creating solutions for them. As a result, one key question would be, “What is the greatest problem we need to solve for.” Then coming up with key priorities around the answer and identifying the top three or so things. If we could do nothing else, what are the top three things we need to address – whether that’s improve access for communities, improve our bottom line, grow a platform or set of services.

It’s identifying the problem we’re solving and who we’re solving it for. One challenge we often run into is that organizations want to see themselves as the central figure in the story. But we need to put things in the proper context – the organization isn’t the hero, it’s the guide. If we can get people into that mindset everything flips and we start seeing the value proposition become clear because, again, we’re focused on the problem we’re solving and for whom. That conversation unlocks everything.

We’re seeing more partnerships and greater alignment between health services and health systems leading to opportunities to increase access in communities and for enhanced growth and profitability. We’ve seen a lot of new activity within the behavioral health space with health services companies partnering with health systems. It’s exciting because there’s investment towards addressing the high demand for behavioral health services.

There’s also the excitement and opportunity around artificial intelligence in healthcare and how providers can integrate AI in various digital platforms. That’s happening in behavioral health, as well. Companies like Synchronous Health are using AI to assess based on an individual’s online activity their risk for behavioral health challenges and then help people recognize those triggers and address them.

This will sound wild, but when we go to the grocery store we can look at a product and see how much it costs. It’s amazing that we have the technology to tell people how much money the need to spend on a service or product upfront.

Seriously, for all the advance we’ve made in healthcare, just that simple aspect of being able to tell the patient how much their care will cost would blow people’s minds. Of course it’s a challenge because of the shape of the healthcare ecosystem where no one entity owns the answer, and there are a lot of variables. But, when we talk about consumer trust and patient trust, we could move mountains by being able to quickly and simply understand what the cost of care is.

Our Public & Community Health Systems practice serves independent and government-owned hospitals, practices and medical centers at the community level.

Employees are engaged now more than ever, allowing providers to rely less on temporary labor. They have a team of core folks who are there for patients, leadership and the community.

Billing and payer negotiations are always front of mind. About half of community hospitals are independent, and many feel they can’t do this alone. Many have realized they need to enter into a partnership, whether it’s a full acquisition or a merger of equals with another community hospital nearby. So, a big challenge has been exploring with leaders and governance what this partnership will look like.

Thinking internally, we’re dealing with many employees who are not reachable in the same way as others. Nurses, for instance, are not in front of a computer all day with access to email communications. So, engagement is an issue. What we learned in the pandemic is: Yes, we can do virtual. But people still crave interaction, even over the screen.

Leaders need to think and act like communicators. That may mean getting out of their offices and purposefully engaging with people – from those working at the bedside to those working from home.

Everything is always changing — it’s communicating the change that’s the problem. This year, health systems and hospitals need to be better at communicating what they’re doing to evolve and be able to meet the needs of the community. They need to be using technology to evolve faster and tell the stories of that evolution.

First, just being in those conversations for comms leaders is important. We counsel our communications leaders that comms can’t drive operational decisions but can be part of the conversation to talk about the decisions the right way.

Then the question to get unstuck is, What are the solutions we’re providing? We’re making this big, operational change, now how are we making that change less of an issue for our patients and employees — how are we communicating it?

It wasn’t exactly unconventional, but it was successful. We had a client very early in the partnership exploration process. They didn’t know what kind of partnership it would be, but they engaged their community to start making a decision. They did listening sessions with employees in the community and narrowed down priorities for those groups, e.g. “These are the 10 things we want to preserve.” They were not only able to use this they searched for a partner, but also down the road, were able to say, “This is what you told us, and we were actually listening. This is going to be a part of it.” Since then, they found a partner, and they still say this initial surveying was the most important part of the entire process.

Our Regional Health Systems practice provides counsel to hospitals serving a geographic region larger than a single city or community.

A commitment to the workforce. In light of all the labor challenges, particularly around recruitment and workforce shortages, regional systems are reinvesting in their nurses, physicians and employees. They are more focused on fostering a culture of belonging and creating environments that are more inclusive. COVID was really difficult for a lot of these health systems. What we saw in 2023 was a concerted effort to prioritize their people in their workforce.

The biggest challenges continue to be those coming out of the pandemic. 2023 was a very challenging year for a lot of health systems – we saw many with declining operating margins. The financial pressure forces hard decisions on how to cut costs and do things differently at the operational level. And so I think we will continue to see that in 2024, though they will be more prepared knowing what 2023 brought.

Communications challenges continue to revolve around how leaders are reaching specific audiences in different employee groups. Organizations communicated very differently in 2023 — I think leaders realized that how they communicated during COVID isn’t sustainable.

One audience that comes to mind is physicians. A lot of these systems have grown their physician base or are working with partners to bring other physicians into their networks, then struggle with how to communicate with them and stay in front of them, keep them informed. That will continue to be a challenge in 2024.

Externally, a need will be to address the continuing anti-hospital rhetoric we’re seeing play out and looking at how health systems are positioning themselves within their communities, within their states and even nationally. There’s also an element of how providers differentiate themselves in their market – they need a very sharp value proposition.

For regional systems where the calendar year coincides with the fiscal year, it’s a turning of the page. We encourage our clients to embrace that moment and start the new year with an eye towards doing things differently than what didn’t work the year before.

The question I’d ask is, what’s the tone that we want to set for 2024 across our organization? The second question is: what will prevent us from getting there? What’s going to stand in our way? What are our barriers from achieving that vision or that tone we want to set?

And then the followup for an executive team is, what are we going to be doing specifically to drive that down through the organization? How are we going to set the tone all the way down to staff on the front line?

We’re seeing a lot of regional health systems smartly partner with non-traditional provider organizations in order to enhance their revenue streams and combat some of the financial challenges they’re continuing to face. So that diversification is part one.

Another example is, I think what some of these regional health systems are doing right now is thinking less about a specific business methodology and more about how they can be flexible and agile in how they operate on a day to day basis. That means empowering all levels of your organization to problem solve; to innovate; to ideate.

Many regional systems are also looking to focus more on delivery of care and offload some of the – to put it bluntly – expenses that are maintained when an organization has a broad portfolio. Things like revenue cycle and supply chain are being outsourced more and more.

I would love to see healthcare providers, and regional systems in particular, be more bold with digital technology and transformation. What if there was a way for patients and consumers to design their own healthcare experience? Or, there was true integration of health information across all your devices, providers and platforms?

I’d also like to see regional systems figure out an effective, cost-efficient way to integrate AI and virtual reality into their care delivery. For example, leveraging AI to provide real-time health updates to patients, help consumers track, monitor and refill prescriptions and or embed it into way-finding when you visit a facility. What’s more, imagine using virtual reality to walk a patient through a process or procedure before it happens so they know what to expect. I think if health systems want to compete with Amazons of the world, they’re going to have to think digital and consumer-first.

Our Academic Health Systems practice provides counsel to academic medical centers and systems – organizations with academic, research and training programs.

We’ve seen positive progress in the number of academic clients who are figuring out both who they’re going to be and how they can best serve their communities. With more academic medical centers and health systems partnering with community health hospitals and health systems, that’s bridged the gap between the ivory tower and community health as they’re looking at different ways of providing care. A great example of this and an area where academic healthcare is uniquely positioned to lead is hospital-at-home. That’s an area where tapping into the innovation and the financial strength of academic healthcare is helping to push patients towards getting care at home when they don’t actually need a hospital.

There are the obvious, industry-wide pressures: Tension with payers is one. Labor is another, it’s been a big story this year. We’ve all been talking about labor for years, and this year the balance really tipped. That’s not going away. Academic health systems have a different set of internal politics when it comes to labor. They have a much more politically diverse constituency in universities with their faculty, so that adds complexity to how they address these issues.

Beyond that, an interesting challenge – or opportunity – is with physician relationships. Particularly as academic systems are acquiring or affiliating with community hospitals. You’re bringing in community docs who may not want to be affiliated with the academic system, and you have academic faculty who want to remain delineated from other physician groups. So an interesting challenge is figuring out how those groups work together and how they’re compensated.

Across all of these areas [above] there’s a significant opportunity for communications-as-strategy. That’s where communications leaders ought to be playing. Given other technological developments that we’ve been talking about over the last year, the time of a communications department being the place that generates newsletters is ending. Thinking about the internal and external political ramifications of all of the ways that academic health systems are growing is probably the highest and best use of communications leaders and communications strategy.

“What are we trying to accomplish? What is the end goal here?” At Jarrard, we talk about “what’s the win?” That’s another way of saying it. Sometimes people get stuck in process or hurdles and if we can work backwards from that, staying focus on the end result we’re striving for in any given endeavor, it’s a useful way to reframe how to get there.

The biggest opportunity for health systems is partnerships with community health providers and systems. There was a big piece in Modern Healthcare recently about how those partnerships will continue to pick up. That’s an interesting combination. It’s getting at finding the best path forward to combine academic capabilities, innovation – all the things that are associated with the ivory tower – with true community health. Providers are figuring out how to develop a shared mission and how to pull the best from each other while leaving some of the excess behind.

It shouldn’t be a weird idea but something we’ve talked a lot about this year is wanting to see healthcare providers get on the front foot as far as what their value proposition is to consumers. Healthcare providers are still far too slow to advocate for themselves in the face of some fairly founded attacks and some unfairly founded attacks from people with a wide range of entrenched interests.

Something like price transparency is a good example. It’s illustrative because hospitals have been attacked on price transparency. They were dragged by regulatory activity into a machine learning world without taking the lessons of what the attacks were based on. And, what they were based on was, “We don’t understand how any of this works, can you please explain it.” Hospitals didn’t explain it enough, so the provider side of the industry needs to think about how to genuinely make changes that are made with the patient in mind, then show a genuine financial and political commitment to amplifying those changes.

Our National Health Systems practice provides counsel to provider organizations with a footprint that covers multiple regions, divisions or communities across the country.

A big win for making healthcare better is how large national health systems have partnered with institutions of higher learning to not only help to solve the long-term issue of workforce shortages, but also help create a healthcare workforce that looks like the community that they serve. A couple examples include the CommonSpirit -Morehouse School of Medicine partnership to what HCA is doing with HBCUs and HSIs across the country and with their new medical school.

The biggest challenge that I helped a national client with this year was a system-wide cyberattack that hit a system of more than 20 hospitals. It brought all of their operations to a screeching halt and they had to go back to operating on paper and caring for patients without any sort of IT infrastructure. Then they had to communicate across every facility about what was up, what was down, and what was happening next.

Across the board we’re seeing large national health systems with big targets on their back. They’re big brands with large footprints across the country, so there’s a lot of interest in preparing for various issues and advocating for either their nonprofit status or for their place in the community.

As we look ahead to an election year, that’s not going to change. Healthcare is going to be a major theme both in the presidential election, as well as state and local elections. Health systems will continue to be asked about their position on a number of hot topics. They really want to be prepared to answer those and to answer them consistently across their footprint.

What I’d love to say is, “What would Dolly do?” Because I love Dolly Parton. But my real answer is that we want to get clients really focused on the single most important thing that they need their people to know, to say, to do. If we can take whatever issue it is and boil it down to a sentence or two, that helps them focus in on what the most important thing is. Then it’s about figuring out the right channel and the right cadence and the right spokesperson. Focusing on that key message about what we’re trying to accomplish tends to break the ice a bit.

It goes back to my earlier answer about large health systems partnering with institutions of higher learning and community organizations to solve for some of the labor shortages that we’ll continue to face for years and likely, decades. I recently spoke with a client that had just released their quarterly earnings. Labor costs were a contributor to less than perfect earnings numbers. We’re not going to be able to fix that until we have more qualified healthcare workers who can jump in and work at a health system and then want to stay through strong retention efforts.

One thing our clients have learned is how to reach frontline workers. They’ve learned this not only from other healthcare organizations but other, disparate organizations where employees aren’t on a computer all day. I was at a conference earlier this year and listened to how brands like UPS and FedEx are reaching their their drivers and warehouse staff. How large convenience store chains were reaching their employees that often only work in pairs and are really far removed from a corporate office. It was fun to hear those examples of how they’re using platforms like FirstUp to reach employees and then to have a discussion with health system clients about how can we implement similar technologies and similar strategies to create systemness. It all goes towards getting people to rally behind an organization’s mission, vision and values.

There are a lot of PHI challenges to replicating in healthcare many of the experiences I enjoy as a consumer. But I would love for someone to come up with a solution that keeps your data safe and secure, but also helps tell you as the patient, what you need and what you should be doing for your health beyond just going to your primary care physician once a year.

I’d love to see a more dynamic, ongoing relationship and experience. Target knows what I want and sends me ideas. Amazon does the same. I wish that I had a healthcare provider that could do that, and I think anything is possible. PHI challenges have certainly slowed progress, but it would have not only a huge impact on those of us who live busy lives, but also those who need more education around how to be healthier, how to make good decisions and when to seek care.

We asked four broad questions to veteran advisors across legal, operations, innovation, digital, strategy, patient experience, marketing and more. Big takes: More of the very Hard Choices healthcare leaders are already navigating…and being ever smarter with the limited resources that remain. Welcome to 2023.

Read through it all, or click on the headshots below to skip right to each expert’s insight.

We asked intentionally broad questions to give each expert latitude to answer based on their own perspective and professional expertise. The diversity of perspective and nuance among responses was clear. And yet, there was dramatic overlap in the themes highlighted by each panelist. That triangulation – seeing similar answers from, say a transaction attorney and a digital expert – points directly to the themes healthcare providers will want to focus on in the new year. Here are those themes.

Note: In January, we’ll share findings from our 5th national survey of healthcare consumer perceptions, touching on many of the themes identified here.

The persistent shortage of healthcare workers was a universal theme. The issue is acute across the care continuum, but particularly challenging at the level of primary care – where pent-up demand is highest and the where the patient journey typically starts.

Full stop. Lower incomes and shrinking margins, along with reduced investment returns, either lead to every other issue or make solving them difficult.

Provider organizations will have to evaluate every investment and partnership. Tradeoffs loom. Health equity and workforce support are necessary – how do resources for those priorities get allocated? It will be a year of frank talk and tough decisions with a fierce need for clear and transparent communication from leadership.

After making hard choices comes taking action on them. Provider organizations can’t cut their way to success. They also need to “actively create what’s next.” That means no favoritism towards legacy solutions and openness to those delivering the highest impact at lower cost. Even if there’s an initial investment in time, money and training.

Or better ones for provider organizations. Whether through M&A, joint ventures or with payers. Though opinions vary on the likely pace of M&A activity in 2023, our panel agrees that mergers, acquisitions and partnerships will continue to make headlines as provider organizations seek the most efficient and sustainable path forward. Financial challenges will also push more productive conversations between providers and payers, perhaps spilling over into collaborative innovation. (One can hope!)

The challenges present an opportunity for transformation of tools and overarching digital strategies. It’s far more than telehealth – which is necessary and no longer a differentiator. Transformation means everything from saving money by reallocating print resources to digital marketing, to allowing patients greater access to their PHI through technology, to evaluating patient usage of mobile apps and improving ADA accessibility on web properties.

It’s part of the patient experience, it’s part of supporting the healthcare workforce, it’s part of fulfilling the mission to care for the whole person. And now, it’s also a business and regulatory imperative with ratings and credentialling agencies using equity as a metric.

This runs the gamut from the tangible – useable digital tools – to the conceptual – full transparency. Patients are looking for convenience to make accessing healthcare easier and more consumerized, ways to expand the front door of primary care, and clarity about how things work in healthcare and what they cost.

The mental health crisis – for the public and for healthcare workers – had been a topic of conversation for years before soaring into view during the pandemic. The issue of addressing people’s needs in a holistic way so they can live well and be productive – and be happy while doing it –remains in 2023.

People like and trust those who deliver care. While they value the role of hospitals and health systems – especially since the pandemic – the highest praise goes to caregivers themselves. However, our experts noted that some people don’t – or would prefer not to – think about their local hospital. And there’s also a just-under-the-surface skepticism about transparency and accessibility efforts, as well as lingering suspicion from days of rampant COVID-19 misinformation. That flashes a yellow light to provider organizations, and should compel them to frequently ask themselves the question, “Is what we’re doing operationally and conveying publicly truly representative of a patient’s experience at our system?”

Want to learn more about the details of each theme referenced above? Here are the responses provided by each panelist.

Workforce and Inflation. The first thing people do when costs rise is put off caring for their own health. Additionally, with all facets of healthcare struggling to keep up with demand, staffing will continue to be one of the most important challenges to tackle.

In terms of staffing, I hope to see better pay and working conditions along with an increase in young people going into the medical fields due to the demand and opportunity for a solid career trajectory. But the U.S. needs to make it a financially viable career path, especially for PCPs, OBs, etc. One major concern regarding staffing is people – who already put off care due to COVID and may be behind in receiving simple wellness checks – not being seen in a timely manner. Additionally, the continued struggle for people to find PCPs who are accepting new patients.

Transparency for patients regarding health records and costs, especially with institutions potentially charging money for sending messages to doctors via patient portals in the coming year. No more excuses for not being able to provide information about cost of procedures. Make that information readily available to patients via patient portals – especially if you are going to start charging to simply answer a patient’s question.

In terms of what’s cooled off, telehealth – it’s expected and offered by everyone and no longer a differentiator. Now, it’s about how you improve upon the experience and make it easier for patients of all ages to receive care remotely.

There is certainly increased trust and respect for the work of hospitals, health systems and the medical field in general. But I think patients, aka consumers, are increasingly frustrated by a system that makes it incredibly difficult to find and receive the care they need in a timely manner along with a complete lack of transparency when it comes to costs for procedures and services. The insurance companies blame the health systems, and the health systems blame the insurance companies, and patients and clinical providers are stuck in the middle. This is something marketers need to especially keep in mind when it comes to communications and marketing materials: Is what you’re conveying truly representative of a patient’s experience at your system?

Inflation, workforce challenges and investment losses dominated 2022. Along with recovering from the pandemic’s impacts on operations, these forces are leading well-positioned hospital systems of all sizes to seek increased scale providing operational, financial and clinical efficiency. Hospital transactions, which have been down since 2019, are roaring back in 2023 as organizations prioritize patient care, quality and access over historic governance structures.

The fragmentation of the American hospital system bears significant responsibility for its high costs and middling quality. Consolidation leads to more profitable hospital systems with higher quality and better patient outcomes. Scale benefits can take time to materialize, especially when the consolidation is the result of a weak organization that delayed partnering as long as possible, but improved quality will be the result of this trend towards larger, more efficient hospital systems.

Multi-region transactions will be a hot topic in 2023. For example, as Advocate and Atrium stated in their merger communications, the Midwest and the MidAtlantic are now adjacent healthcare markets. While the scale benefits of hospital transactions can include in-market clinical and referral synergies, those tend to be secondary to the market-independent structural synergies of best practices, corporate finance, population health infrastructure, purchasing and other synergies. However, to fully realize those benefits, organizations typically need to undergo structural and ownership change, indicating that loose affiliations and other “dip-the-toe-in” partnerships are likely to cool off in 2023.

People are expecting more from their hospital systems. While they trust, appreciate and support their care teams, they are increasingly skeptical of the organizations for which those clinicians work. Layer in front-line labor challenges and patients directly shouldering an increasing share of the healthcare dollar and the frustration becomes palpable. However, the industry remains filled with folks who entered healthcare to help others. Organizations that can build environments where those folks want to work will be successful going forward.

Inflationary pressures (including the cost and access to capital) coupled with skilled labor shortages should be the predominant headwind in 2023. Our practice diligences healthcare services in a broad swath of sectors – big and small – and these trends, unfortunately, continue to worsen as we enter the new year. Perhaps in a distant second is the likely increased regulatory focus that usually accompanies a split Congress.

Unfortunately, there is likely to be some distress followed by restructurings – both in and outside of court. Those acquirers whose balance sheet and operations allow are going to have some compelling M&A opportunities.

The M&A landscape has cooled from a record 2021 and hot 2022 (through Q3). That said, healthcare M&A is nothing if not resilient and, as we know, recession resistant. The march towards value care and innovation through healthcare consumerism are also poised to make some big leaps in 2023 with ‘real’ capital lining up to advance their efforts.

The public values and trusts their physicians and care teams, including their local hospitals. I think there are other players in the healthcare ecosystem that are less trusted, and there are going to be some questions brought to the forefront about how the pandemic was handled in connection with the aforementioned divided Congress. That could exacerbate the shaky footing.

If picking just one thing, it would be a continuing workforce crisis for all our healthcare clients, particularly hospitals and health systems. We simply don’t have enough front-line healthcare providers to meet the demand.

The shortage is causing crippling labor costs, and there’s no significant mitigation of this problem on the horizon. In addition to stripping hospital margins, workforce shortages in key areas will likely continue to drive a shift towards access through digital healthcare platforms.

Again, there should be an uptick in telehealth services and remote patient monitoring. There are some very innovative solutions available that could continue to change the way healthcare is delivered.

Also, expect new rules related to HIPAA and information blocking – healthcare data privacy and security will continue to be huge.

On a different note, it’s tough to ignore what looks to be a continuing crisis in mental health – more people are being impacted, and it’s a continuing need that must be addressed.

Finally, I see a continued trend toward more non-traditional companies getting into healthcare.

Our client hospitals and health systems have rallied public support well in the COVID era and have burnished their reputations as critical community assets. This could be one of the major lasting impacts of COVID – additional well-deserved respect is accorded our local healthcare systems and, in particular, our community healthcare providers.

Workforce development and labor shortages. It is underappreciated how durable the labor disruption will be. Healthcare has not faced a shortage of resources in 50 years and, as such, has not been forced to make hard choices and/or innovate its way into less dependency on human capital.

It will vary between non-profit and for-profit or, perhaps more accurately, between health systems that are prepared for and actively engaged in cost control, including healthcare’s most significant input, labor. The only answer, ultimately, will be innovation – particularly that which saves time. In the near term, there are likely to be reductions in service lines, backlogs of cases and even reduced access. Ongoing labor disputes are also likely.

The most important trend we see that will aggravate labor and workforce issues is payer conflict. That will probably lead to more health system consolidation, about which the FTC will have fewer arrows in their quiver than they would like. Ultimately, health systems that control their markets will be price setters, and that is the direction many will head.

The public generally supports their doctors and, to a certain extent, the dominant hospital in their region. However, that trust is eroded by a lack of transparency on price and, often, quality. Payer conflicts with employer plans are going to drive even more people into high deductible plans where price really matters as most people become cash payers.

Workforce/labor in every way imaginable – cost structure, retention, burnout, training/development, pipeline, staffing models – has to be put at the top of the list right now. This was mentioned in last year’s predictions for 2022 and it carries forward into 2023.

Another force to highlight is the ever-expanding world of partnerships and M&A activity beyond traditional hospital-to-hospital transactions. Hospital transactions are still a big part of the landscape as we move into 2023, but we are seeing a wider variety of joint ventures and other arrangements in areas such as ambulatory access, digital health, high-reliability care, health equity and payer/health plan products. Our clients are investing heavily in partnerships that fortify their presence across the ambulatory ecosystem surrounding their hospitals.

One anticipated change from workforce challenges will be the continued evolution of new care delivery arrangements including alternative sites and care models. The advancement of digital and key strategies such as Hospital at Home are part of the solution.

We will continue to see health systems focus on building scale and capabilities outside of the traditional hospital component of the healthcare ecosystem. They will not be short of options and partners in this effort, but the challenging economy and limitations to accessing capital will determine how extensively and quickly many organizations collaborate.

All of the areas mentioned above will continue to be hot throughout 2023. In addition, health equity, digital health and programs/models that truly integrate care financing and delivery (especially with managed governmental payer lives) will continue to be top of mind in 2023.

In general, opportunities that are capital intensive and have a long time to market or realization of value have cooled off.

In many ways, the pandemic has fortified the trust that patients have for their providers and health systems. There is considerable admiration for all that providers have done to help us through the pandemic. At the same time, as traditional aspects of inpatient care melt to ambulatory settings and as ambulatory care melts to virtual and at-home settings, the need to expand the health system footprint to offer easy access across the continuum of care is greater than ever.

Digital transformation, which will include affordability and accessibility, particularly with underserved and rural communities.

It would help to close the digital divide. If we can start to think about better broadband access for the most vulnerable, we begin to close that divide. This would also allow more access to high-speed internet for educational and entrepreneurial uses.

The trend of care centers specializing in wellness has cooled off. A lot of them never differentiated themselves enough to make strong strides in the marketplace. My hope is that we get back to basics. I don’t need fancy couches and cappuccinos in the waiting room, I just need good, affordable healthcare.

There’s a lack of trust. I think COVID really exposed the misalignment of info. We’re at a place now where we don’t necessarily know which source to trust. But we’re now dealing with fear-driven policies that are forcing individuals and families to make tough decisions. We need people-centered policies that support healthy outcomes for all.

The workforce is the primary force that will drive healthcare next year. The needs of physicians, nurses and employees should serve as the North Star for all healthcare systems if they want to weather the financial headwinds and be successful. Without a healthy healthcare workforce, there’s no ability to deliver care. There’s no ability to realize and drive innovation. There’s no way to create healthier communities and improve the healthcare system.

It’s not one big change that will solve the workforce issue. Rather it will require HR, Operations, Communications and other areas working together to create a culture where people want to stay and where top talent wants to come to work. There’s a real need for health systems to solve for burnout, address recruitment and turnover issues, find ways to unlock the full potential of the resources they have and create a culture that is rooted in inclusivity and belonging. Not to mention, a reimagined strategy for how they communicate and connect with their workforce. These are the changes that need to happen to build a sustainable workforce and will be the most important work for healthcare organizations next year.

Beyond the workforce, there will be a heightened focus on financial improvement initiatives, including labor and non-labor expenses, patient access and acquisition and health equity. In a sea of strategic priorities, health equity has not been at the top of that list. But with this year’s release of CMS’s framework for health equity and US News & World Report’s unveiling their health equity methodology – not to mention the healthcare disparities and inequities that were illuminated and worsened by the COVID-19 pandemic – it will be interesting to see if health systems finally address this issue and start investing in it.

Honestly, I don’t think the average patient or consumer pays a lot of attention to their local hospital or health system. Especially if they don’t have ongoing healthcare needs. Sure, they trust their provider. But beyond that, how often are they thinking about and engaging with their clinician’s organization? I would wager very little. I think people also view the healthcare system as wildly inefficient, costly and confusing. If we truly want to improve the health of communities and solve some of the underlying causes of our unhealthy nation, provider organizations need to be collaborating with their communities and addressing social determinants of health. Maybe then, patients and consumers will start to see hospitals and health systems in a more positive, visible light – as a place that helps you be well and takes care of you when you’re sick.

“Financial headwinds” will be the primary force and continue to exert outsized pressure on healthcare in 2023. These headwinds, which collectively include things like increased labor costs, inflation, access to capital, reimbursement, and so on, make it challenging for health systems and other industry players to execute on more strategic and innovative strategies. Notwithstanding that, collective demand for improved performance across the industry remains high, which will require health industry players to evaluate their portfolios, geographies and partnerships to enable improved ability to provide accessible, high-quality care to the patients and communities they serve.

With every challenge comes an opportunity, so these financial pressures are motivating organizations to move more quickly on strategies across the care continuum. This pressure will hopefully result in innovations to address a lot of pain points providers are currently experiencing, from labor force to patient experience to cost management. We’ll see a lot of healthcare organizations looking beyond their own four walls to outside collaborators to harness the power of their own data, work more efficiently and develop solutions that “work smarter, not harder.”

Even as the economy presents challenges, expect healthcare mergers and acquisitions to continue in the year ahead. For those in the position to buy, this opens the door to acquiring distressed assets or consolidating with others. For others, portfolio reassessment will result in divestitures or joint ventures of assets that organizations no longer feel compelled to wholly own and operate.

What has not cooled off is the conversation about workforce wellness, as providers and staff remain stretched. That conversation should continue as there is no substitute for nurses, doctors and those on the front lines in caring for the population, even when that care is becoming more virtual in some instances.

We’ve certainly learned over the past several years that healthcare workers and healthcare organizations are essential. While patients may have trust in their individual providers and maybe even their local hospital or health system, there is great dissatisfaction with the incredibly complicated puzzle of providers, payers, pharmaceuticals and the sources of healthcare funding. The increased focus on well-care and not sick-care will enable different engagement between consumers and the health care system, which raises the prospect of a healthier health system for all.

Workforce/labor will continue as a singular challenge for healthcare systems and providers. It adversely impacts access to care, quality of care and financial well-being of organizations. Many hospital systems will still not be able to open all their licensed beds due to the inability to staff them.

Within the sizeable group of hospitals that already operated at single-digit or negative margins, many will seek to consolidate with other systems or dramatically restructure. I’m optimistic that for hospital systems that have proactive and engaged leadership, this dynamic will lead to innovation in delivery models and technology – perhaps even in collaboration with payers and employers.

Payers, providers and investors continue to focus on delivery models and technology that allows healthcare to be delivered at home or otherwise outside the hospital or physician office. Consumerism and “bending the cost curve” will drive this trend through 2023 and beyond. Provider organizations will increasingly assume financial risk, and payers will continue to build out provider-side capabilities. Ironically, dedication to outcome-based reimbursement models such as improved clinical outcomes, preventative care targets or reduction in medical errors, seems to have stalled a bit and isn’t perceived as a solution to the near-term existential threats providers face.

I can honestly report that I have seen unprecedented community support for and goodwill towards their local hospitals, health systems and providers. This is particularly true for hospitals and health systems that are transparent about industry challenges and aggressively engaged to tackle them. In my experience, community stakeholders want to be part of the team and the discussion.

Our health system M&A clients are most concerned with achieving financial sustainability and addressing quality-of-care issues in the face of organizational stress. These forces have caused a significant increase in parties considering transactions.

We sampled ~15 health systems that our team is working with around the country in evaluating M&A opportunities. Two-thirds are hospitals seeking a larger partner. One-third are larger systems pursuing growth. 20% are local government-sponsored, 20% faith-based, and 60% secular. Local Governments are the category most likely to undergo change in the coming years.

The high degree of variance in the regulatory environment from state to state cannot be overstated. Our bankers are working on transactions in 13 states and involve 35 hospitals. The difference in pace and stance toward business in markets like California, Illinois and New York is vastly different from states like Alabama, Georgia, and Kansas. That has a bearing on partnerships motivated by a desire to construct new facilities or pursue vertical integration.

Many of the independent hospitals we are working with are seeking partnerships that address community relations, transparency and patient experience. The role of foundations has taken on greater importance. Nonprofit acquirors are now more commercially skilled and are utilizing structures that create meaningful proceeds to further support health needs in the community. Some of these resources are filling a void that exists in lower acuity, non-hospital settings.

Lawson & Associates

Significant operating income losses coupled with declining investment returns will force hospitals and health systems to reduce non-corporate initiatives and staffing. Over the last few years significant effort has been placed on health equity efforts, so health systems will need to reconcile the costs of those endeavors with increased salary demands by clinicians.

Significant and strategic communication resources will be needed for public and internal communications should health systems trim back social initiatives. It’s easier to initiate on these than retreat. Threading the needle will require outside communication assistance.

Quality parameters will become a priority for antitrust regulators looking at mergers and collaborations. Health systems will need to match quality measurement variables to insurance company models long before requesting mergers. Health systems will also need to reach across the aisle to insurers to start building trust early rather than ending up in what are too often combative negotiations.

As both a current, long-term patient and a healthcare executive I respect both sides of the equation. Patients trust the health system as long as their care team is supportive. When healthcare workers are negative towards a health system – in public or private – then the public’s opinion will turn. It’s one thing to address public protests, but more difficult to assess and manage are private bedside discussions between caregivers and patients. That’s where the focus needs to be both short and long term.

Ongoing financial constraints caused by inflation, rising costs of labor, etc.

We hunkered down and got through the pandemic but have emerged with seemingly more intractable issues to face. Something has to give: Providers can’t just grind through or cut their way out of financial challenges. Healthcare no longer has the luxury of maintaining the status quo, doubling down on what’s always been done or wasting precious time overly focused on what competitors (or Amazon) are doing. In 2023, healthcare providers should focus as much energy and as many resources as they can muster in creating what’s next, getting clear on what they do best and carving out a brand position and strategies that are laser-focused on who they want to be and leaving behind who they’re not.

We all need to continue investing in the transparent conversations that started in 2020. After all, there’s a reason that the consumer brands that invested in communications in 2020 and 2021 increased in value by an average of 43% during that time.

What’s hot: Responses to all the tough forces at play, such as…

People don’t think about hospitals and health systems unless they have to. People “in the real world” are busy with their own lives, struggles and priorities. Most only think about provider organizations when they need care. They may think about provider organizations as they consider their skyrocketing insurance premiums, but otherwise most would prefer to think about the hospital only when they need it…which they hope is not often.

Was that the first thing you said as a teenager coming home after your first day of your first job slinging guacamole at a fast-food restaurant? Nope? Wasn’t for us either.

But that did happen to a teen whose orientation at Chipotle included a pathway to go from line crew to store manager to franchisee. And what a profound lesson for healthcare organizations struggling with staffing, said Dan Collard, co-founder of Healthcare Plus Solutions Group, who recently shared the story with us.

As Collard sees it: Recruitment starts with retention when companies give employees a reason to stay and grow.

Healthcare’s persistent workforce shortage is one of the industry’s most daunting issues right now. Everything’s on the table: large sign-on bonuses, retention bonuses, raises as everyone competes to staff up, whatever it takes. Many, especially rural hospitals, are barely hanging on. A few numbers to illustrate the point:

Rural hospitals having difficulty filling nursing roles

Increase in salaries and benefits reported by HCA in 2021

Rural hospitals significantly increased reliance on travel nurses

Nurse leaders citing employee emotional health as key concern

We all know the problem illustrated by those numbers. But how did it get so complicated?

Social context. The great resignation is affecting every facet of the workforce, with retention of hourly employees particularly tenuous.

Damsky

Expectations for greater pay, better benefits, improved work-life balance, career development opportunities and a desire for a better connection with employers are leading employees to push for change and/or leave their position in pursuit of it. Nurses, techs and shared services employees are expressing those same expectations but with the added layer of the intensity of their work.

Different process. “How people are going about getting talent has evolved as nursing recruitment has been empowered by technology. That’s making it more costly and more competitive,” said Pamela Damsky, director and Performance Practice co-lead at Chartis.

Jung

Jeffrey Jung, engagement manager at Chartis, pointed to the rapid rise of placement firms and “matchmaking technologies” that help connect provider organizations with talent. Jung said the matchmaking software can increase the speed at which a nurse can be placed and make better matches on the front end to boost retention. “It’s cheaper than just using placement firms because of the technology, but the overall cost is increasing because there are so many more applicants being hired,” he said.

Jennifer O’Meara, senior digital strategist at digital marketing firm Eruptr,

O’Meara

said the recruitment campaigns her firm ran online before COVID-19 tended to be “as needed” and focused on RN recruitment. Now though, Eruptr is involved in comprehensive recruitment campaigns that run constantly across platforms. Budgets, she said, “are double and triple what we were running previously, and it’s not just SEM, it’s Facebook, it’s Instagram, it’s display ads, it’s YouTube… it’s everything.”

More competition. Atop increased cost due to shifting talent acquisition processes is the pressure to raise compensation through bonuses and higher salaries to compete with other organizations in the market for a smaller and, perhaps, more selective talent pool. Hospitals are vying for the same nurses and trying to fend off the travel firms. At the same time, nurses and other staff have far more options, with outpatient clinics and health services companies delivering outstanding care and offering attractive careers.

Frayed relationships. The pandemic has accelerated a breakdown between title bands. Leaders are working to keep the whole operation running, staff are keeping things clean and caring for patients, managers are liaising between the two. Nurses aren’t happy. They’re being asked to do more with less. The LinkedIn post from nurse Kelly Fassold illustrates it well. Fassold compellingly expresses the anger many nurses feel towards administration, regulators, hospital groups and anyone else trying to codify salary caps – or even just discuss nurse compensation. The relationship between administration and staff is broken, and nurses feel like they are – or actually are – on the outside looking in as discussions about their value take place. It understandably leads to the sentiment of being both disrespected and undervalued. “You’ve left us out of the conversation and you don’t understand what we do so how can you tell us what we’re worth?”

The healthcare staffing crisis isn’t intractable, but it’s not going to be solved in the short term. Right now, healthcare execs and HR teams are doing whatever is necessary to have just enough staff on shift to deliver care. Whatever it takes. That only adds to the unsustainable feedback loop and the feeling that we’re in the middle of a land grab, making it that much harder to plan for the long term. But plan we must. In fact, we must redesign the whole thing.

To do that, we have to establish the environment for long-term change to take root. First, a few thoughts on the tactics hospitals and health systems can employ.

Hospitals and health systems are activating a variety of strategies to staunch the bleeding of the workforce crisis. We’ve curated a list of short and long-term interventions in force today and arranged them by feasibility for different types of provider organizations. After all, very few health systems have the financial wherewithal to buy a nursing school the way HCA did with Galen College of Nursing nearly three years ago.

Remember that nursing challenges arise indirectly as well when other areas of the organization break down. Take environmental services. When that department is understaffed, nurses end up with additional responsibilities because who else will change the linens? It’s more rocks in the nurses’ backpack.

Collard referenced a health system that was struggling with retention among environmental services and other support staff. Leadership changed the employee onboarding process so that, instead of following up with new techs after 30 and 90 days, those conversations happened on days one and two. That kept new hires engaged and allowed managers to uncover questions and problems instantly rather than letting them fester, improving the likelihood that the individual would stick around.

Again, wise to stay vigilant on the indirect disruptions that spill over onto nurses and address them promptly.

Our experts agree there’s no easy solution, and the hard, sustainable solutions involve completely rethinking how we deliver care. But then they cite something that absolutely can be accomplished: building a culture that makes people want to stay. And when people stick around, you save on acquisition and training costs, maintain workforce stability and naturally gain advocates who may recruit others.

But O’Meara cautioned: “If you have to talk so much about culture and sell people on it when recruiting, do you really have a good culture to begin with? Is that culture reflected once you get past the advertising and the recruiters who make you feel so great about everything? Is it reflected once a new hire gets into the clinical setting?”

Professional development

Collard

Back to guacamole. After telling the story of the young man’s first day at Chipotle, Collard drew the contrast with healthcare organizations. “On Day One, we’re more interested in getting people set up with their password for the electronic medical record and showing them which gloves to wear,” he said.

In the push to get people working on their floor as quickly as possible, there are so many priorities to check off the orientation list that nothing is a priority. In contrast, Collard asked rhetorically, what if hospitals were more like Chipotle? “What would it be like if we began to engage our clinical staff on the day they started?” He mentioned research findings that indicate nearly four of five millennials will take a job with lower pay if it’s a job they feel connected with and that provides them a clear career path. It’s not always about the money. (Although yes, the Chipotle post below does feature the money along with the career trajectory.)

Jung emphasized this point, too, but with less avocado and red onion. Before COVID-19 there was less enthusiasm for bringing in a new graduate “because they require so much hands-on involvement,” as he put it. That hesitancy to hire novice nurses and techs is changing, and what’s becoming important now for retention in a smaller labor pool is giving people a clear pathway to move and grow.

Carter

A specific example of this in healthcare comes from Dawn Carter, a veteran healthcare strategist and founding member of the Rural Healthcare Initiative. She said that from the moment they initially consider a healthcare career throughout their time with an organization, people need to see how they can grow in their job or grow into another one. Hospitals that are already helping finance additional technical/educational investments have a massive leg up – they should do everything to make those opportunities known.

Carter cited a speaker from the 2022 South Carolina Hospital Association meeting who suggested hospitals ensure that high school students understand the low-cost path to a high-paying job. Someone paying two years of technical college tuition and coming out of it with an RN can enter the market making $60,000, but there’s the potential for $200,000+ by pursuing a CRNA.

Another example? Take the entry-level hospital employees working in “central sterile” cleaning surgical equipment. The skill level is such that they could work at an Amazon warehouse for more money and skip the dirty equipment. Hospitals, Jung said, can and should create a defined career ladder for techs. Many techs are in nursing school, and if you create those relationships and provide the opportunities, they’ll eventually want to come back or continue employment when they graduate, he said. “It’s the difference between a very transactional, ‘We need you here’ and a relational, ‘We’re going to invest in you – and we’d love for you to go back to school,’” he said.

Nurse-manager relationships

Go back to that LinkedIn post above. The post, and several comments below it, are built on the idea that unless someone has done the job they can’t know what it’s worth. It’s a push against salary caps, but it also reveals the significant gap between the suits and the scrubs. And it’s a fair point. The system is broken, staff see their census and patient acuity steadily increasing and the message many hear from managers and administration is a combination of, “Keep going,” and, “We can’t give you what you want.”

But again, sometimes what people want isn’t necessarily money. “We need to be sure we have salaries that match the market, but it’s more than dollars,” Damsky said. “It’s also treating nurses with respect and meeting their needs and creating an environment where they want to be.”

Carter highlighted the desperate need for leaders to spend time with staff, having heartfelt conversations about what they’re experiencing and humbly – not defensively – discussing leadership’s position on the issues and the various imperatives they’re balancing.

Sometimes it’s effective for managers and executives to share their own stories. We’ve heard from clients whose leadership spoke during town hall meetings about their toughest moments during the pandemic. Showing that level of vulnerability was powerful and helped dampen some of the tension that had been building.

Note that these conversations shouldn’t be used as distractions from or substitutes for practical interventions. They should be a supplement, a way to both solicit helpful information about what staff need and to demonstrate that the organization is working towards a collective solution.

Leadership development

Over the past couple of years, particularly during the omicron surge, we’ve seen an increase in non-clinical staff stepping in to help fill gaps. There are stories of managers running to get blankets, leaders helping empty trash. It’s certainly not happening everywhere or all the time, but more frequently than ever before.

That’s all well and good…but interestingly, our experts noted that it’s not necessarily the best thing. Plugging holes is an important crisis response and it’s great for showing staff that leadership is engaged, willing to do whatever it takes. Even so, there are drawbacks. “Leaders have been rolling up their sleeves and diving in,” Collard noted. “If I’m in that position, it means I’m spending less time leading and more time doing on the unit.”

NOT EVERYONE WANTS TO BE A TRAVEL NURSE

— Nurse A 🖤🩺 (@Nurse_Lyss) February 5, 2022

We reference compensation throughout this piece and noted that it’s not always about the money. Two reasons for that:

According to Eruptr’s Jennifer O’Meara, hospitals in bigger cities with more competitive markets are relying more on bonuses and the financial incentives, while rural facilities and systems lacking competition but without the financial wherewithal are focusing on the intangibles. Think quality and cost of living. She said that in many recruitment campaigns there’s less emphasis on the standard “great culture” line and “a big push in online campaigns and in discussions about how making this move can be better for your quality of life.”

Cessna

Joel Cessna, Eruptr’s vice president of sales pointed out another example of alternative compensation for rural locations and those that can’t compete financially: creative benefits packages. For example, five weeks of vacation vs. three. “That’s a critical thing nurses are looking for, especially when you think about the exhaustion and burnout today,” he said.

Organizations need to find ways to get leadership out of staffing and back into leading, while equipping them to lead effectively. It’s the management version of practicing at the top of one’s license. It doesn’t mean someone never steps in to do something that isn’t in their job description. It means they’re doing their best so that they can help those in their care and on their team do their best.

“Leadership development becomes really important,” said Damsky. “It’s the thing that falls by the wayside because who has time for it?” There’s a cost when leadership development is put on the back burner and, conversely, a clear benefit when it’s maintained. Damsky mentioned a client who tracks employee engagement against their organizational development work. “They ask questions like, ‘Does my manager make me feel valued?’ and track that against staff turnover. They’re looking for negative correlation,” she said.

Helping staff feel valued involves moving leader rounding beyond checklists and perfunctory appearances. Collard said that it’s training leaders and giving them the space to have relationship-centric conversations. He said, “So when a leader says, ‘How are you doing?’ it means, ‘I’m not just asking, I’m really interested. It’s just me and you right now. How are you? What do you need?’” Collard cited a large medical center where a high-caliber ER nurse quit suddenly. When the team did some digging, they found out she hadn’t left for an agency to make more money. Instead, there were things at home affecting her ability to stay at the hospitals. Per Collard, the nurse executive said, “Oh my gosh, if we’d only known, we could have done something to help her!”

Eventually, healthcare provider organizations will be able to shift some of the focus from the crisis of filling shifts to the long-term structural change that will make staffing far easier. Many had laid such groundwork pre-COVID. And there is an array of remarkable health services companies rolling out software and innovative care models to solve the problem. Artificial intelligence, remote nursing, hospital at home, standardizing meal prep across a system, automated revenue cycle – everything that will put nurses and staff in a position to do what they do best and offload much of the rest.

We’re not there yet, but the foundation is in place and the frame is starting to take shape. In the meantime, provider organizations must step back to ensure that even as they continue the necessary scramble to fill shifts, they’re laying the groundwork. That means giving everyone in the organization permission and practical support to keep going. Starting on Day One.

Nurses unions have been talking about staffing levels and compensation for years. Now, the conversation has come to them. Hospital advocacy groups could push back saying that it didn’t make sense to implement rigid staffing requirements; organizations of different types and sizes and locations needed flexibility. But on the heels of the pandemic, staffing has become a core concern, both among the public and healthcare workers – a point proven by the most recent Jarrard Inc. national survey.

The public citing staffing shortages as a top concern

Healthcare workers citing staffing shortages as a top concern

In addition, the business side has come to the forefront, and with it a rising skepticism among nurses and staff about the intentions of their employers. Some feel organizations are holding patient care over nurses’ heads while, in the background, pushing the business forward. The response is essentially: “We can’t be the only ones carrying the weight of our mission. If you expect us to be the only mission-driven people, we’ll go travel or organize and strike.” In addition, the employee-manager relationship is starting to ring hollow. Historically, a core argument against organizing is that a union only adds complexity, getting in the way of those direct conversations. But more and more nurses are feeling – or recognizing – that they don’t actually have that relationship and their voice isn’t valued. In that case, they’re not giving anything up by bringing in a third party.

There’s no easy fix for provider organizations. The solution is long term – doing the slow, hard work of engaging employees, giving them a real voice in conversations and training leadership to lead effectively. Before making any statement about valuing nurses’ input or taking any action to ostensibly boost engagement, ask whether the move represents a true, long-term commitment or is simply lip service, an attempt at a quick fix. Worried about organized labor? Give people a way to not need that third party.

"*" indicates required fields

It can conjure the other side, the opponent, the adversary against whom “we” are fighting. That word is being bandied about between providers and payers in the escalating feud over the high cost of healthcare. And it suggests that behind closed doors, negotiations between those two parties are getting nastier as the cost of healthcare comes back into focus.

Case in point: “That doesn’t mean they’re not going to try to use this,” said USC healthcare professor Glenn Melnick earlier this year while suggesting hospitals are abusing COVID-19 relief funds. His apparent purpose was to assign blame and set providers as the adversary.

Scanning headlines, it’s obvious that the intense public spotlight pointed at hospitals pre-pandemic has returned (remember surprise billing and hospitals suing patients?). Talk of healthcare heroes is ebbing way, with chatter flowing about the evils of consolidation and health systems driving the cost of care while focusing on profits over patients. Hospitals are being framed as “Them.” Unfortunately, the newsworthy stories about poor billing practices, limited access or other non-consumer-friendly behaviors are self-inflicted wounds by specific hospitals that create opportunities for other actors to paint with a broad brush, undermine providers’ positions and cast doubt about their motivations.

Meanwhile, the insurance industry is working to remake its image from a poorly understood and disliked group to the torch-bearers for patient-centric care. “We.” “Us.” It’s even rebranded its trade association to “AHIP” and is using broader messaging to get away from the focus on insurance. All of this appears to be part of an orchestrated campaign, that’s quite frankly, a savvy PR move.

(4-minute read)

As the Delta variant raged hot this week and hospitals began to curtail services, we asked 1,200 US adults about their thoughts and feelings about the pandemic*. Here’s what stood out:

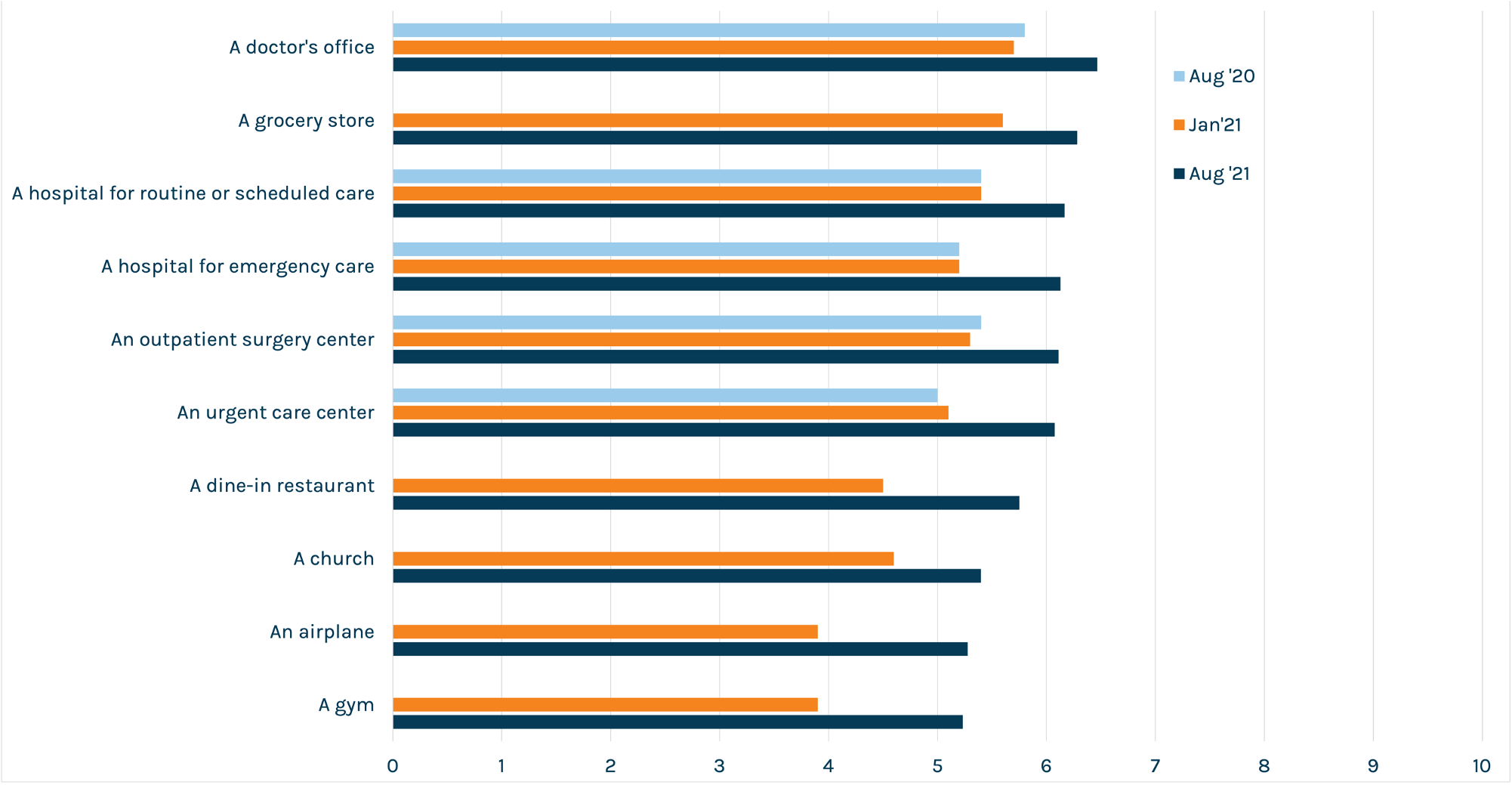

Several questions continue threads we’ve been pulling in our various consumer surveys over the past 16 months. In each, we want to understand people’s feelings of safety in different settings. (See findings from last April, August and this January.)

Here’s the latest healthcare consumer intelligence:

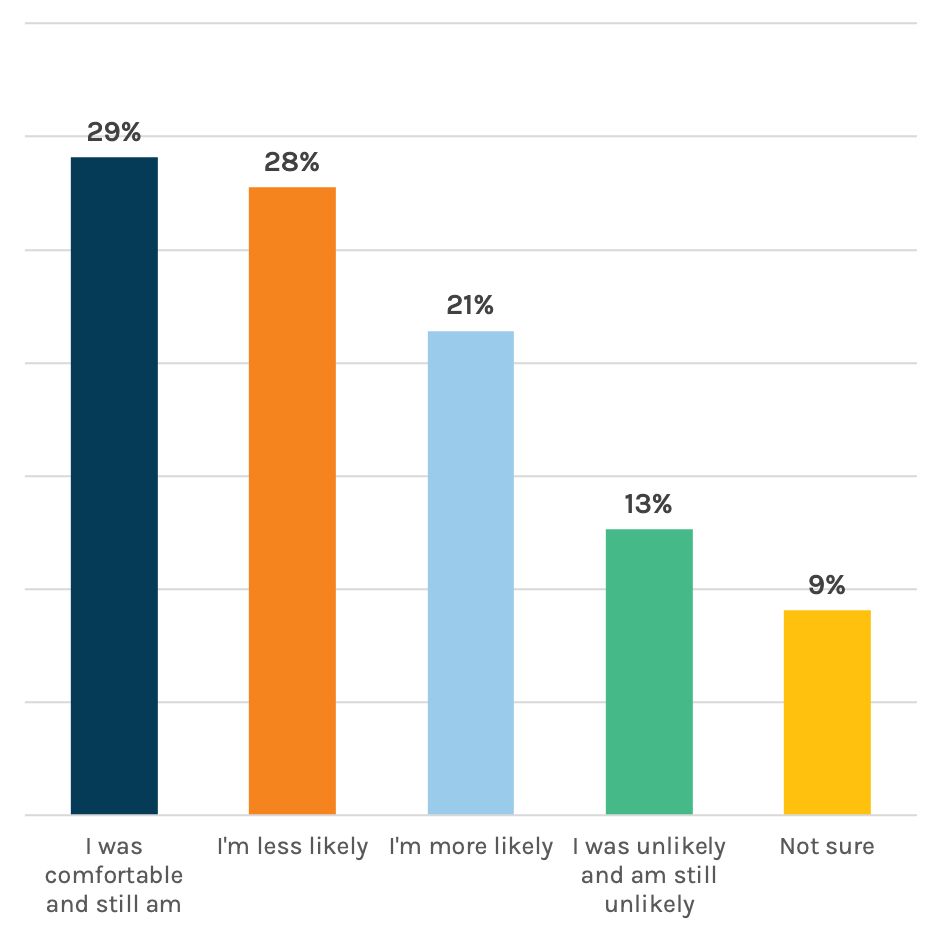

In-person care has some people nervous. We asked consumers if the current COVID-19 situation has changed the way they’ll seek non-emergency care – in person and via telehealth. Twenty-eight percent said they’re less likely to pursue in-person care. A smaller proportion is actually more likely to seek in-person care. (Yeah, we don’t get that either. Maybe they think wait times will be shorter?) But, the largest shift is in the wrong direction – a tough situation for providers who had a taste of returning volumes this year and now may be facing the need to scale back services due to the latest surge.

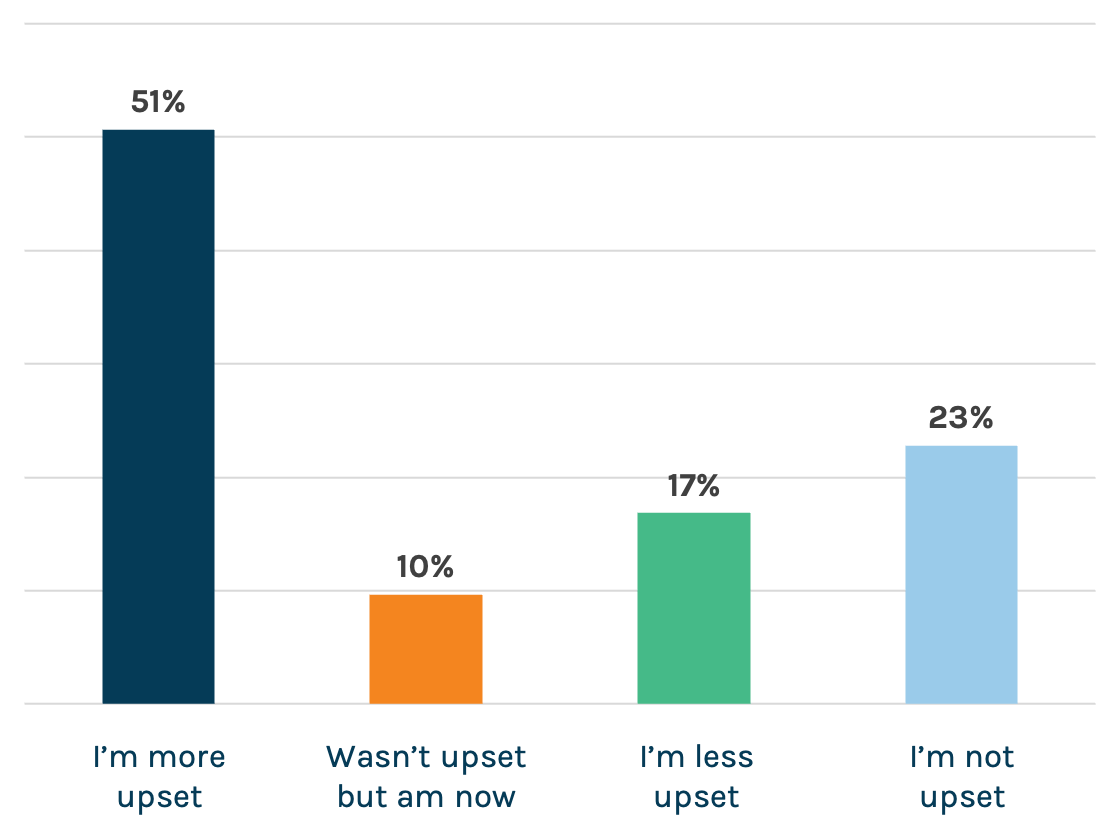

On the other hand, it looks like providers can expect an uptick in patients seeking remote appointments, as 44 percent said the current situation makes them more likely to pursue the virtual route. It’s a great reminder that telehealth needs to stay front and center. Marcom teams should play a strategic and tactical role here, helping shape public perceptions of safety, comfort, convenience and different options for care. It pays to keep patients abreast of any changes along the entire care process – from scheduling to arrival to checkout and billing.